It is expected, with a probability of almost 100%, according to the CME Group, that the Fed will raise interest rates by 25 bp to 5.5%, and this decision is already priced in. But here's how the Fed leaders will act further in relation to the parameters of monetary policy, here the intrigue remains. Many economists believe Fed officials will pause the tightening cycle as early as the August meeting, only to move on to easing later this year or early next.

On Thursday, a whole block of the most important macro statistics from the US will be published, including data on the volume of orders for durable goods and capital goods and a preliminary estimate of US GDP for the 2nd quarter.

Also tomorrow, the ECB will hold its meeting on monetary policy, and on Friday - the Bank of Japan. If the ECB is expected to raise interest rates again, then the Bank of Japan is likely to leave its key interest rate in negative territory, keeping it at -0.1%.

However, some economists still allow for possible adjustments, namely, in controlling the yield curve of government bonds.

Under this program, the Bank of Japan aims to keep the yield on 10-year Japanese government bonds (JGB) near 0% to stimulate the economy. Every time the JGB market yield rises above the target range, the Bank of Japan buys bonds to lower the yield (the yen is under negative pressure when the JGB yield falls).

Although, Bank of Japan Governor Kazuo Ueda assured on Wednesday that "the long-term yield rate in Japan remains stable within the framework of the yield curve control policy" and "the Bank of Japan will maintain favorable monetary policy conditions for companies."

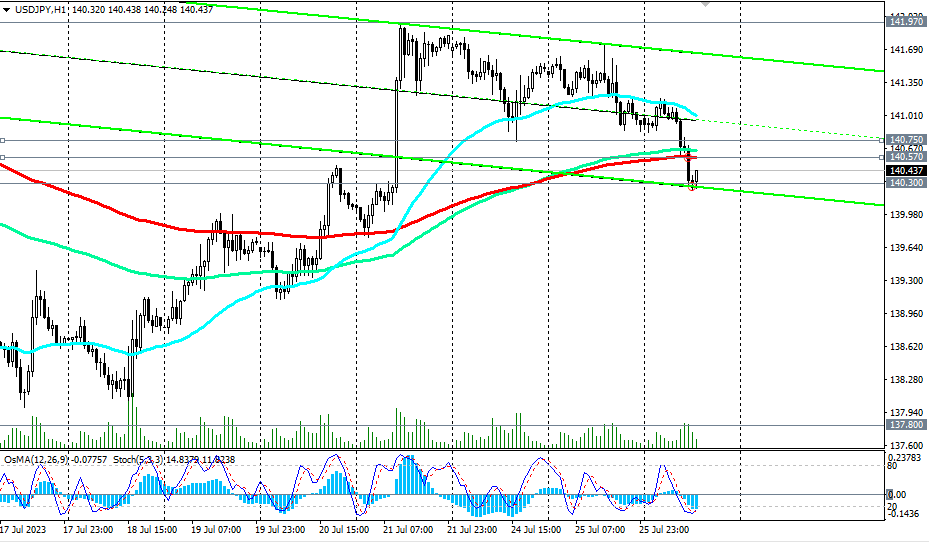

Given the upward long-term and medium-term trends, it is logical to expect a rebound in the current zone and the resumption of the upward dynamics of USD/JPY.

In this case, the breakdown of the resistance levels of 140.57, 140.75 will be the first signal to resume long positions, and the breakdown of the local resistance level of 142.00 will be a confirming one.

USD/JPY remains in the bull market zone - medium-term, above the key support levels 137.80, 136.80, long-term, above the key support levels 126.70, 123.40 and global (above the key support level 111.20).

Therefore, in our opinion, long positions remain preferable. But to enter them - only after the breakdown of the level of 140.75.

Support levels: 140.30, 140.00, 137.80, 136.80, 136.00, 129.60, 126.70, 123.40

Resistance levels: 140.57, 140.75, 141.00, 142.00, 143.00, 144.00, 145.00, 146.00, 148.70

- see also “Technical Analysis and Trading scenarios" -> Telegram - https://t.me/traderfxcrypto

- more details -> https://www.instaforex.com/forex_analysis/349860?x=PKEZZ