A more significant decline in USD/JPY is hampered by the extra-soft monetary policy pursued by the Bank of Japan. The Bank of Japan currently remains the only bank among the world's largest central banks that keeps interest rates in negative territory.

This factor alone contributes to buying the dollar at the expense of a cheaper yen, according to the so-called carry-trade strategy.

Given the weak macro statistics coming from Japan and the relatively low inflationary pressure, one should not count on a change in the course of the super-soft monetary policy of the Bank of Japan.

However, the Bank of Japan does not rule out the possibility of foreign exchange interventions to stabilize the exchange rate of the national currency in case of its excessive weakening. However, this will not be of cardinal importance for changing or breaking the bullish trend of the USD/JPY pair.

Most likely, it will continue, not excluding short-term periods of correction, which we are now observing.

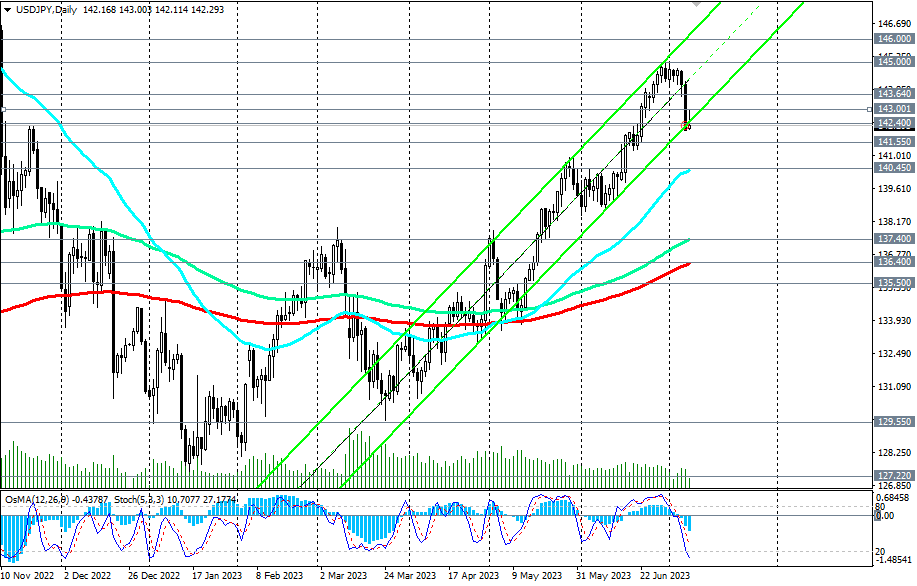

Therefore, in our opinion, it would be appropriate to open new long positions near the support level of 142.40, as well as when the price drops to the support levels of 141.55, 141.00, 140.45. An alternative scenario of a stronger strengthening of the yen is being built amid expectations of a possible change in monetary policy parameters by the Bank of Japan at its meeting on July 28 regarding the control of the YCC yield curve.

The Bank of Japan in December 2022 doubled the cap rate on 10-year Japanese government bonds from 0.25% to 0.5%, expanding the range from zero in both directions by 0.5% and accelerated bond purchases to protect the (yield) ceiling. Then this caused a sharp strengthening of the yen and the fall of the USD/JPY pair.

If the Bank of Japan at the meeting on July 28 once again expands the yield range of the JGB, as it was at the meeting in December, then we can expect a new round of the strengthening of the yen and the fall of the USD/JPY pair.

On this, in fact, the calculation of the sellers of the USD/JPY pair is based. And the closer this date is, the stronger, in our opinion, the volatility in the pair will grow. By the way, some economists believe that the Bank of Japan may completely abandon the yield control program this year. It is easy to assume that even in the conditions of a low interest rate of the Bank of Japan, this could lead to a serious strengthening of the yen.

Support levels: 102.20, 102.00, 101.50, 101.00, 100.75, 100.00, 99.50

Resistance levels: 102.50, 102.87, 102.92, 103.00, 103.40, 103.55, 104.00, 104.65, 105.00, 105.85, 106.00, 107.00, 107.80

- see also “Technical Analysis and Trading scenarios" -> Telegram - https://t.me/traderfxcrypto

- channel - https://www.mql5.com/en/channels/fxcryptotrader

§ more details -> https://www.instaforex.com/forex_analysis/348309?x=PKEZZ