The general problem of the investor is:

where w being the portfolio weights, and U utility function of portfolio risk σp and return μp.

CAPM assumes investors with concave utility function U=μp−12σ2p, from which then follows that all investors mix the market portfolio with the riskfree asset according to their desired minimum risk/maximum return level.

I believe using a different nonconcave utility function would indeed change the model.

There is a paper on the necessary conditions for the CAPM utility function here which states:

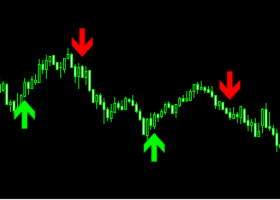

We all can understand the nature between greed and risk, fear and gain... But do we really want to take the measures for dynamic rule based trading?

Please share your comments and we can bring more balance to our unified community. Thank you.

(http://www.princeton.edu/~kahneman/docs/Publications/prospect_theory.pdf)