RTCSPECTRA is a powerful trading system that combines two popular techniques in the forex market: martingale and scalping. It has been running for more than 8 months and has yielded fantastic and safe results. In this article, we will explore the positive and negative aspects of the martingale and scalping techniques, discuss the importance of verifying EA performance using MQL5 signal, and provide some advice for readers interested in developing or purchasing an EA.

Martingale and Scalping Techniques

The martingale technique is a popular betting strategy that originated in France in the 18th century. It is commonly used in forex trading, where traders double their position size after a loss in an attempt to recover the previous losses. The technique is based on the assumption that the market will eventually turn in the trader's favor, allowing them to recoup their losses and make a profit. However, the martingale technique has its drawbacks, as it requires a significant amount of capital and can lead to substantial losses if the trader experiences an extended losing streak.

Scalping, on the other hand, is a short-term trading strategy that aims to take advantage of small price movements in the market. Scalpers typically hold their positions for a few seconds or minutes and rely on high leverage to amplify their profits. However, scalping also carries significant risks, as the market can be volatile and unpredictable, and small price movements can quickly turn against the trader.

Positive and Negative Aspects of Martingale and Scalping

Martingale and scalping are two popular trading strategies in the Forex market. Martingale is a strategy that doubles the trade size after a loss, with the aim of recouping the previous losses and making a profit. This strategy is often used in a volatile market, where the trader can expect a trend to reverse soon. However, the major drawback of martingale is that it can quickly deplete the trading account if the market moves against the trader.

Scalping, on the other hand, is a strategy that involves making multiple trades in a short period of time, aiming to profit from small price movements. Scalping is a low-risk strategy, as the trades are usually closed quickly, limiting the exposure to market volatility. However, this strategy requires a high level of discipline, as it can be difficult to make consistent profits from small price movements.

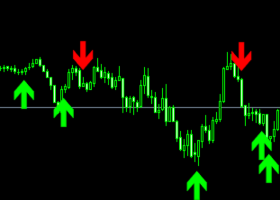

RTCSPECTRA combines both martingale and scalping strategies to maximize profits while minimizing risks. The system uses a series of technical indicators to identify entry and exit points, as well as to manage risk. The combination of martingale and scalping techniques in the RTCSPECTRA trading system offers several benefits. The martingale technique allows traders to recover from losses quickly, while the scalping technique enables them to profit from small price movements. However, using these techniques without proper margin management can lead to significant losses. This is because martingale involves increasing the trade size after each loss, which can quickly deplete a trader's account if the market moves against them. Similarly, scalping involves making multiple trades in a short period of time, which can lead to overtrading and increased risk if not managed properly.

Therefore, it is important for traders to use proper margin management techniques when implementing martingale and scalping strategies. This includes setting appropriate stop-loss and take-profit levels, as well as using proper trade sizing and risk management techniques.

Overall, while martingale and scalping have their risks, they can be effective trading strategies when implemented correctly. The RTCSPECTRA trading system combines these techniques to maximize profits while minimizing risks, making it a reliable and effective tool for traders.

RTCSPECTRA is a trading system developed by our team that uses both martingale and scalping strategies. The system has been running for over 8 months and has produced fantastic and safe results. In this article, we will discuss the positive and negative aspects of martingale and scalping, as well as the importance of having live results that can be verified through MQL5 signals. We will also provide a link for readers to try or purchase RTCSPECTRA.

Live Results and MQL5 Signals

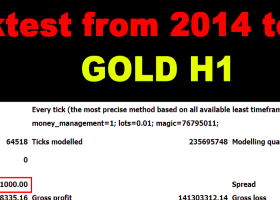

It is important to note that any trading system or EA that cannot be verified with live results is simply a marketing gimmick. Many developers promote their EAs with backtest results, which do not reflect the reality of the market. Live results, on the other hand, show the actual performance of the trading system in real-time. RTCSPECTRA has been verified with live results, which can be viewed and monitored on MQL5 signals here :

https://www.mql5.com/en/signals/1871550. This ensures that the system is reliable and effective in a live trading environment.

Advice for Readers

When it comes to purchasing an EA or trading system, it is important to do your research and avoid developers who only show backtest results or make empty promises. Look for developers who can provide live results that are verified through third-party platforms such as MQL5 signals. This will help you to avoid scams and ensure that you are investing in a reliable and effective trading system.

Conclusion and Link

In conclusion, RTCSPECTRA is a martingale and scalping trading system that has produced fantastic and safe results over the past 8 months. While martingale and scalping have their pros and cons, RTCSPECTRA combines both strategies to maximize profits while minimizing risks. The system has been verified with live results on MQL5 signals, ensuring its reliability and effectiveness.