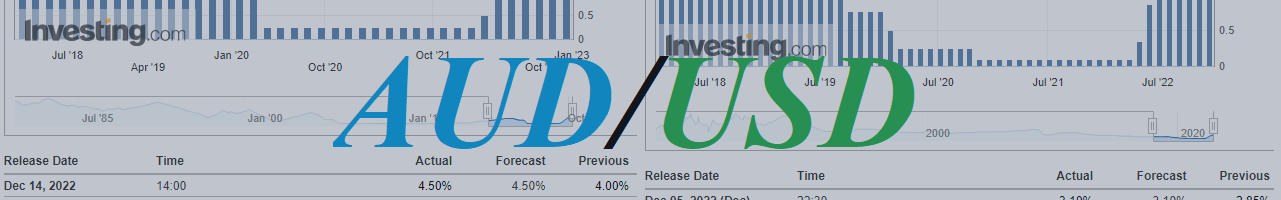

AUD/USD: technical analysis and trading recommendations for 12/20/2022

Since mid-October, AUD/USD has been in an upward correction, having rebounded from the local “round” support level 0.6200, and in the middle of this month it made an attempt to break into the medium-term bull market zone, having tested the long-term resistance level 0.6830 for a breakdown, and even briefly exceeded the resistance level 0.6880 (for more details, see AUD/USD: technical analysis and trading recommendations for 12/20/2022).

However, so far this attempt has not been successful: in the last 3 trading days. As we noted in our "Fundamental Analysis" today, the AUD/USD tested an important long-term support level 0.6665 today.

We are waiting for a confirmed breakdown of this level and a further decline deep into the downward channel on the weekly chart towards its lower border, passing near the mark of 0.5900. In an alternative scenario, AUD/USD will still break into the zone above the resistance levels 0.6830, 0.6880, demonstrating the determination to move further towards the key resistance levels 0.7090, 0.7160

*) for the events of the week, see Key economic events of the week 12/19/2022 – 12/25/2022

**) about the features of trading the AUD/USD pair, see the article AUD/USD: currency pair (characteristics, recommendations)

Support levels: 0.6684, 0.6665, 0.6600, 0.6500, 0.6455, 0.6390, 0.6285, 0.6200, 0.6170, 0.5975, 0.5665, 0.5510

Resistance levels: 0.6741, 0.6760, 0.6800, 0.6830, 0.6880

- signals -> https://www.mql5.com/en/signals/author/edayprofit

- see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading