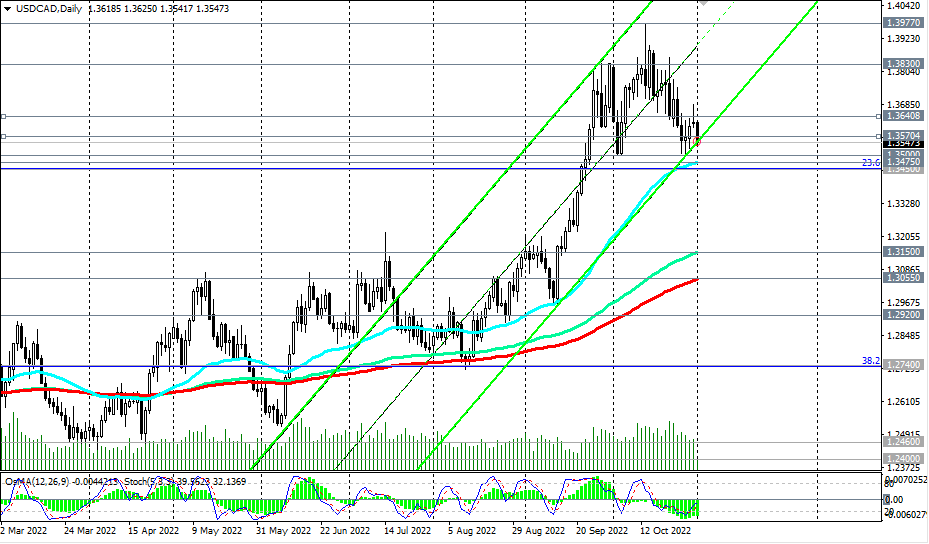

As we noted in today's "Fundamental Analysis", in general, the upward dynamics prevails. In the main scenario, we expect a rebound from the support level 1.3570 and a resumption of growth. The breakdown of the resistance levels 1.3640, 1.3685 will be a confirmation signal for the resumption of long positions. Given the strong upward momentum, it is logical to assume further growth.

The general weakening of the US dollar also contributes to today's decline in the USD/CAD pair. So, at the time of publication of this article, the DXY dollar index is near 110.87, in the lower part of the range formed between the local support and resistance levels 114.74 and 109.37. The general upward dynamics of the dollar remains, and the breakdown of the local "round" resistance levels 114.00, 115.00 will be a signal that the DXY index will return to growth.

Otherwise, and if tomorrow's Fed decision on rates disappoints market participants, the dollar will fall under a wave of sales, causing the DXY index to fall as well.

Support levels: 1.3570, 1.3500, 1.3475, 1.3450, 1.3150, 1.3055, 1.2920

Resistance levels: 1.3640, 1.3685, 1.3800, 1.3830, 1.3900, 1.3977, 1.4000

- see details -> https://www.instaforex.com/ru/forex_analysis/325806/?x=PKEZZ

- signals -> https://www.mql5.com/en/signals/author/edayprofit

- see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading