USD/CHF: as a defensive asset, the franc seizes the initiative

The next Fed meeting is scheduled for September 20-21. So far, it is widely expected that the interest rate will be raised by 0.75% at this meeting. According to CME Group, this probability is taken into account by market participants in 90%.

This, in particular, is helped by the latest data from the US labor market, which remains strong. Thus, the number of initial applications for unemployment benefits last week turned out to be lower than preliminary estimates of 240.0 thousand, amounting to 222.0 thousand.

Recall also that the number of non-farm payrolls in the US rose by 315,000 in August, according to data released by the US Bureau of Labor Statistics. This data followed a July rise of 526,000 (revised from 528,000) and was slightly better than market expectations of 300,000 (Economists estimate that about 75,000 a month of job growth is enough to provide a growing trend and an aging US population with jobs) .

But if Fed officials signal a slowdown in the tightening cycle, the dollar could drop even further. The softer the rhetoric of their accompanying statements, the stronger the weakening of the dollar can be. In the meantime, its DXY index, despite weakening for the 4th day in a row, maintains positive dynamics and the possibility of taking another 20-year high above 111.00.

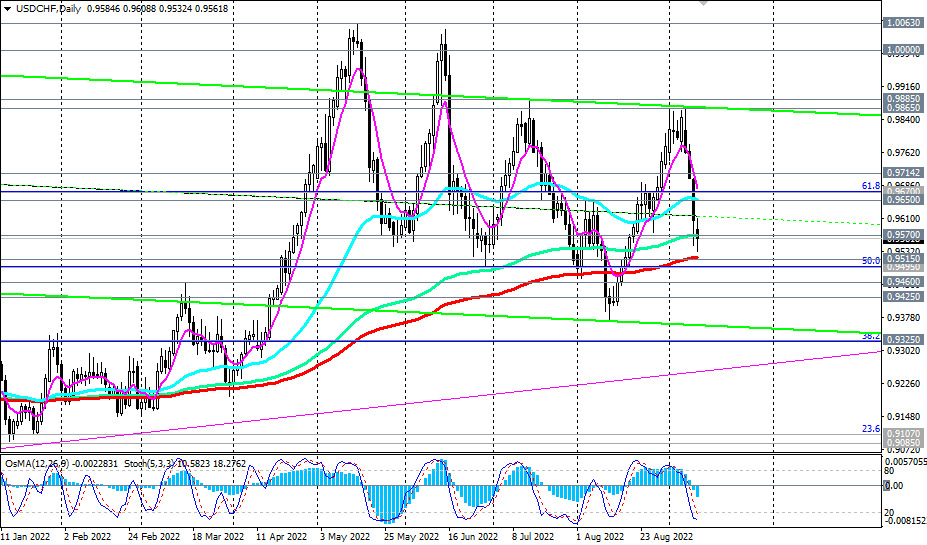

At the time of publication of this article, the USD/CHF pair is trading near 0.9560, being in the zone of key support levels (for more details, see "USD/CHF: technical analysis and trading recommendations for 09/12/2022") 0.9570, 0.9515, the breakdown of which may be a threat the bullish trend of the pair and the dollar.

Support levels: 0.9515, 0.9495, 0.9460, 0.9425

Resistance levels: 0.9570, 0.9600, 0.9650, 0.9670, 0.9714

*) see also

“Technical analysis and trading recommendations” -> Telegram