Range analyzer with alert indicator

The idea behind the Range analyzer is to offer our customers all the necessary analyses to analyze market volatility.

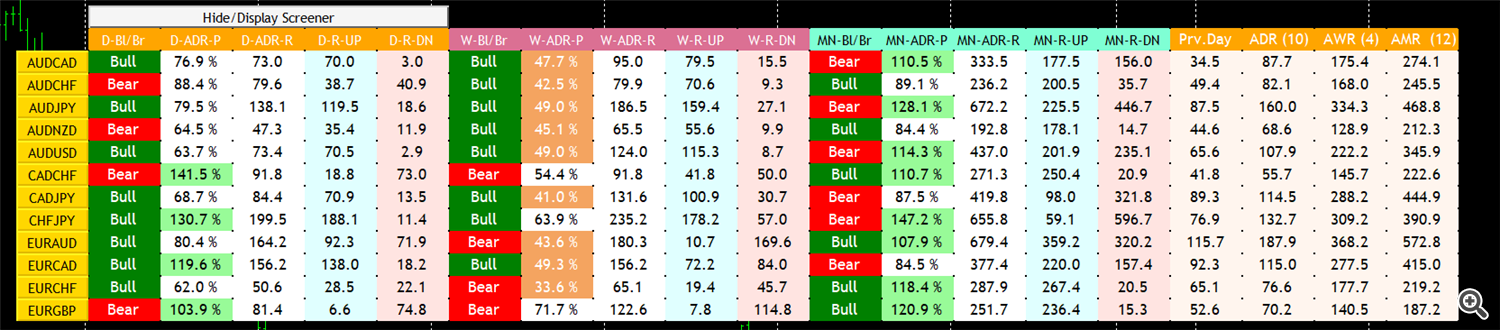

How to read Range Scanner ?

Daily section analysis

D-Bl-Br : Current daily bar is bearish bar or bullish bar.

This parameter will provide direction of the current Daily bar.

- Bull : It means the current daily bar is bullish.

- Beark : It mean the current daily bar is bearish.

D-ADR-P : Daily ADR Percent.

This parameter will provide the percent of current Daily ADR. When the percent is above 100% means that we are experienced a high volatility in that day.

D-ADR-R : Daily ADR Range.

This parameter will provide the ADR ( Average Daily range in pips )

D-R-UP : The distance between the daily open price and the daily high price in pips.

D-R-DN : The distance between the daily open price and daily low price in pips.

Weekly section analysis

W-Bl-Br : Current Weekly bar is bearish bar or bullish bar.

This parameter will provide direction of the current Weekly bar.

- Bull : It means the current weekly bar is bullish.

- Beark : It mean the current weekly bar is bearish.

W-ADR-P : Weekly range Percent.

This parameter will provide the percent of current Weekly range . When the percent is above 100% means that we are experienced a high volatility in that week.

W-ADR-R : Weekly range .

This parameter will provide the AWR ( Average Weekly range in pips ).

W-R-UP : The distance between the weekly open price and the weekly high price in pips.

W-R-DN : The distance between the weekly open price and weekly low price in pips.

Monthly section analysis

MN-Bl-Br : Current Monthly bar is a bearish bar or bullish bar.

This parameter will provide direction of the current Weekly bar.

- Bull : It means the current Monthly bar is bullish.

- Beark : It mean the current Monthly bar is bearish.

MN-ADR-P : Monthly range Percent.

This parameter will provide the percent of current Monthly range . When the percent is above 100% means that we are experienced a high volatility in that month.

MN-ADR-R : Monthly range .This parameter will provide the AMR ( Average Monthly range in pips ).

MN-R-UP : The distance between the monthly open price and the monthly high price.

MN-R-DN : The distance between the monthly open price and monthly low price.

How to use ADR Zone ( Box ) ?

The ADR zone predicts the current day high and low based on the ADR distance.

Trend Reversal case

- If the price touches the high of the ADR zone without breaking it means a trend reversal from a UP trend to DOWN Trend.

- If the price touches the Low of the ADR zone without breaking it, means a trend reversal from a DOWN trend to UP Trend.

Trend Continuation with high volatility case

- If the price breaks the high of the zone, it can result in strong upward direction

- If the price breaks the low of the zone, it can result in a strong downward direction.

When the price is outside of the ADR Zone, it means that today's market is extreme volatility and prices move out of the Average Daily Range.

Example 1 : EURUSD

Example 2 : GBPUSD

Example 2 : GBPUSD

Example 3 : USDCHF

Example 4 : AUDUSD

Please if you have any questions, feel free to post a comment or sending me a PM.

Author

SAYADI ACHREF , fintech software engineer and founder of Finansya.