Fed chief Jerome Powell recently reaffirmed that the central bank's main task is to regain control of inflation, which has reached highs in the US for the past 40 years. If economic performance is in line with expectations, then Powell considers it appropriate to raise interest rates by 50 basis points at the next two meetings.

Today, during the American trading session, he will speak at an event organized by the Wall Street Journal, and market participants will be waiting for new signals from him regarding the prospects for the Fed's monetary policy. His performance is scheduled to start at 18:00 (GMT). It is possible that Powell will hint that at the next Fed meeting on June 14-15, the interest rate may be raised by 75 basis points, and not by 50, as the market expects. In this case, the dollar will receive a powerful impetus to strengthen. If Powell maintains the same rhetoric regarding monetary policy, then the dollar may weaken. However, this weakening will not be long lasting.

Either way, the Fed's stance on taming rising inflation remains the toughest among the world's major central banks. And this is one of the main fundamental factors in favor of further strengthening of the dollar (however, also provided that the Fed's measures are effective).

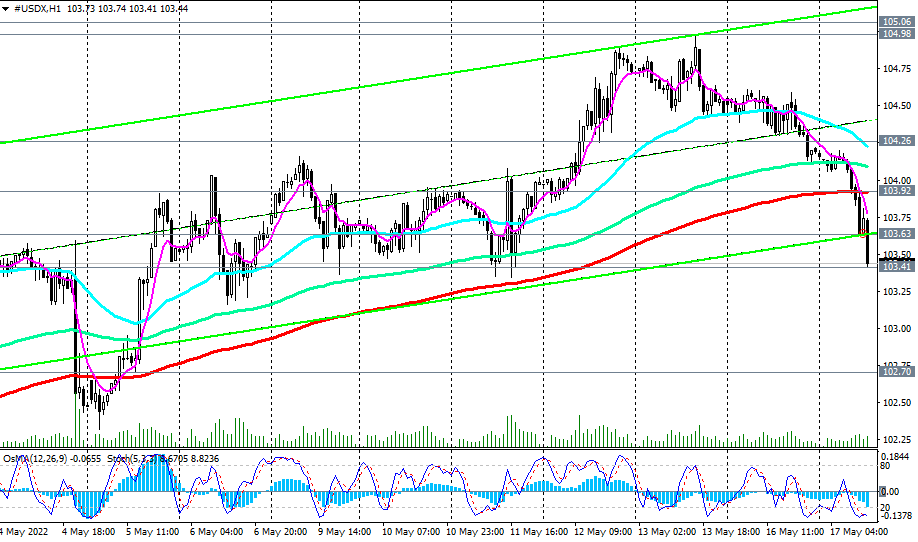

From a technical point of view, the price of the DXY dollar index futures broke through an important short-term support level of 103.92, placing an order for further decline. Breakdown of today's local low at 103.41 may increase the negative dynamics.

If the support level 103.41 fails and is broken, then the downward correction may continue up to the support levels of 102.70, 102.00.

We repeat that we consider the current decline as corrective, expecting the resumption of the upward dynamics of the dollar and its DXY index.

Support levels: 103.41, 102.70, 102.00, 101.16, 101.00

Resistance levels: 103.63, 103.92, 104.26, 104.98, 105.06

*) see also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

Source: InstaForex