American stock indices are falling, oil prices are falling, and with them the quotes of commodity currencies. Meanwhile, the expected beginning of the normalization of the Fed's monetary policy is causing the dollar to strengthen. According to data released last week, inflation in the United States reached a new high in 40 years: the consumer price index in February rose from 0.6% to 0.8%, and in annual terms - from 7.5% to 7.9%. Economists' forecasts suggest that at the meeting, which begins today, Fed officials will raise interest rates by 0.25%, which will begin a cycle of tightening the US central bank's monetary policy. In recent comments, Fed Chairman Jerome Powell noted the possibility of multiple rate hikes this year, given rising inflation.

Of greatest interest will be the Fed's press conference, which begins on Wednesday at 18:30 (GMT). A more hawkish stance on monetary policy is viewed as positive and strengthens the US dollar, while a more cautious stance can be seen as indecision and negatively affect the USD.

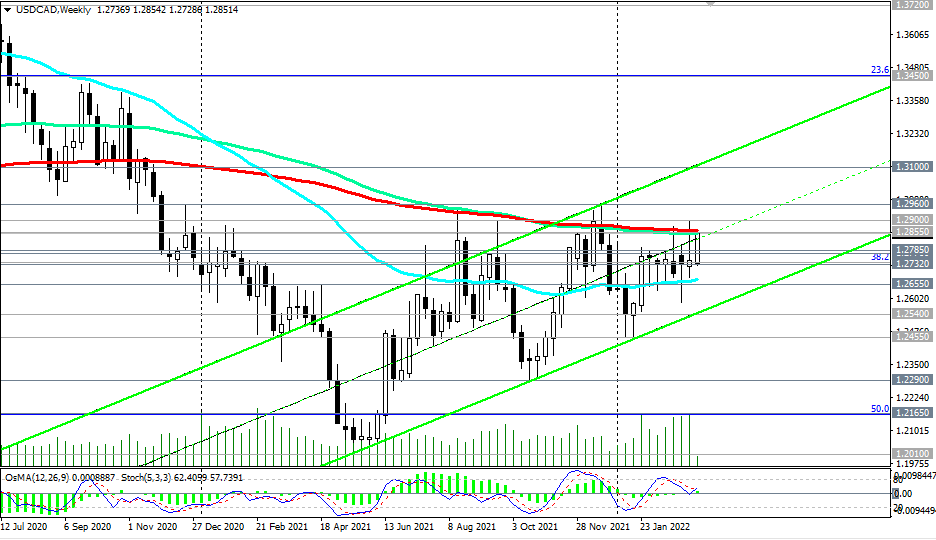

As for the USD/CAD pair, it is growing for the second day in a row after a 3-day decline the day before. We adhere to the USD/CAD growth scenario towards a more distant target and the resistance level of 1.3450 (23.6% Fibonacci level).

In an alternative scenario, the first signal for the resumption of short positions will be a breakdown of the local support level 1.2810, and the confirming one will be a breakdown of support levels 1.2785 (local support level), 1.2776.

see also -> Trading recommendations

*) the most up-to-date "hot" analytics and trading recommendations (including entries into trades "by-the-market") - https://t.me/fxrealtrading

**) Get no deposit StartUp bonus up to 1500.00 USD