The dollar continues to dominate the market. Investors give preference to it against the backdrop of ongoing hostilities in Ukraine. Last Monday, the DXY dollar index topped 99.41, hitting a 21-month high.

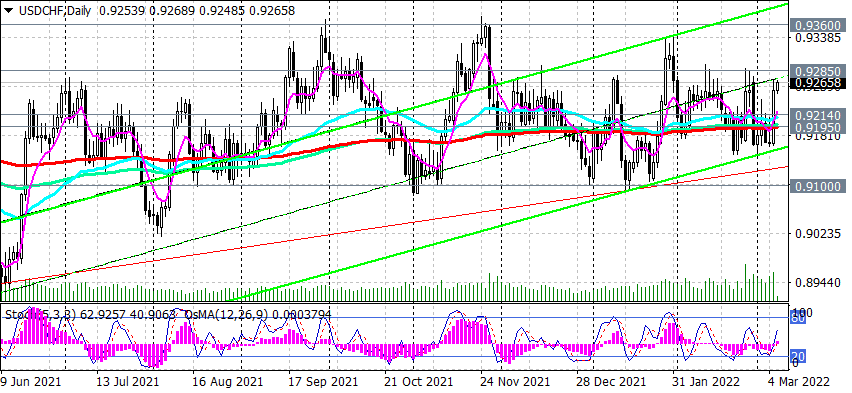

USD/CHF pair has been trading in ranges since last June, with a wider range between 0.9410 and 0.9000 and a smaller range between 0.9360 and 0.9100. A kind of balance line here is the 200-period moving average on the daily chart, which is currently passing through the 0.9195 mark.

Franc received some support from the optimistic macro statistics from Switzerland, published on Monday. Thus, the unemployment rate in Switzerland decreased in February to 2.2% from 2.3% in January and the same forecast. However, the main support for the franc comes from its status as a defensive asset.

USD/CHF is traded near 0.9260 mark, staying above the important support levels 0.9214, 0.9195. Above these support levels long positions remain preferable, and in the event of a breakdown of the resistance level 0.9285 (the upper limit of the range located between the levels 0.9100 and 0.9285), the growth of USD/CHF will continue with targets at the resistance levels 0.9360 (the upper limit of the range located between the levels 0.9360 and 0.9100), 0.9410.

see also -> Technical analysis and trading recommendations

*) the most up-to-date "hot" analytics and trading recommendations (including entries into trades "by-the-market") - https://t.me/fxrealtrading