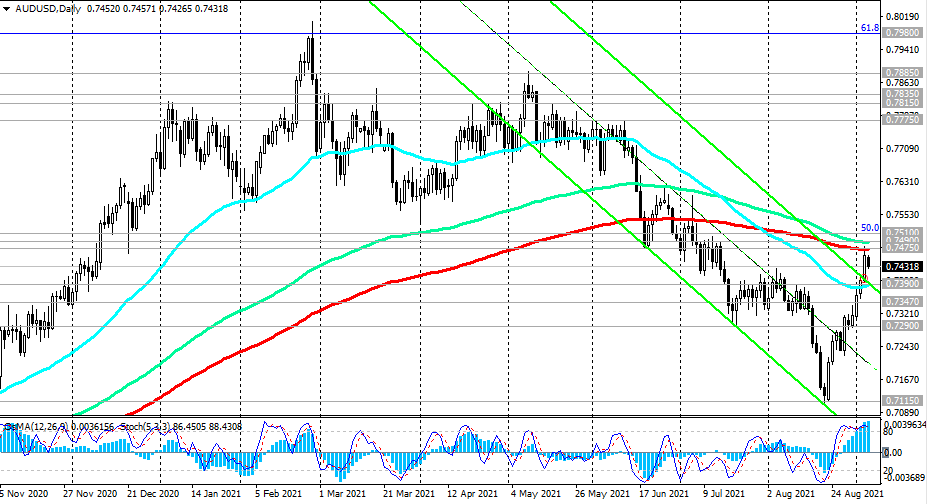

The breakdown of the resistance levels 0.7475, 0.7490, 0.7510 (Fibonacci level 50% of the correction to the wave of the pair's decline from the level of 0.9500 in July 2014 to the lows of 2020 near the level of 0.5510) will indicate the resumption of the long-term upward dynamics of AUD / USD and its return to the bullish long-term market.

In an alternative scenario, the first signal to resume the downtrend will be a breakdown of the short-term support level of 0.7421. Breakdown of the support levels 0.7390, 0.7347 will confirm this scenario, and AUD / USD will go deep into the descending channel on the daily chart, towards its lower border and support level 0.7037 (Fibonacci level 38.2%).

Trading Scenarios

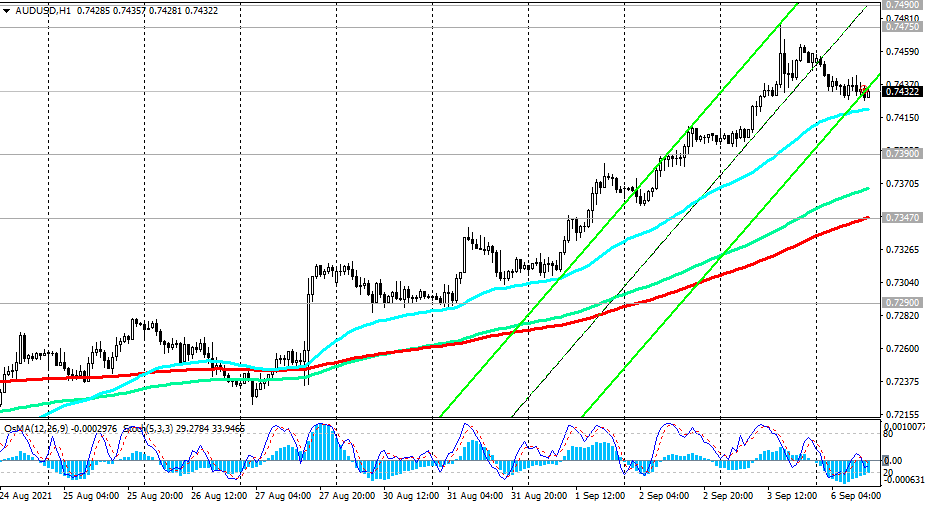

Sell-Stop 0.7415. Stop-Loss 0.7480. Take-Profit 0.7390, 0.7347, 0.7290, 0.7115, 0.7037

Buy Stop 0.7480. Stop-Loss 0.7415. Take-Profit 0.7490, 0.7510, 0.7775, 0.7815, 0.7835

*) AUD/USD: Current Fundamental Analysis and Market Expectations

**) the most up-to-date "hot" analytics and trading recommendations (including entries into trades "by-the-market") - https://t.me/fxrealtrading