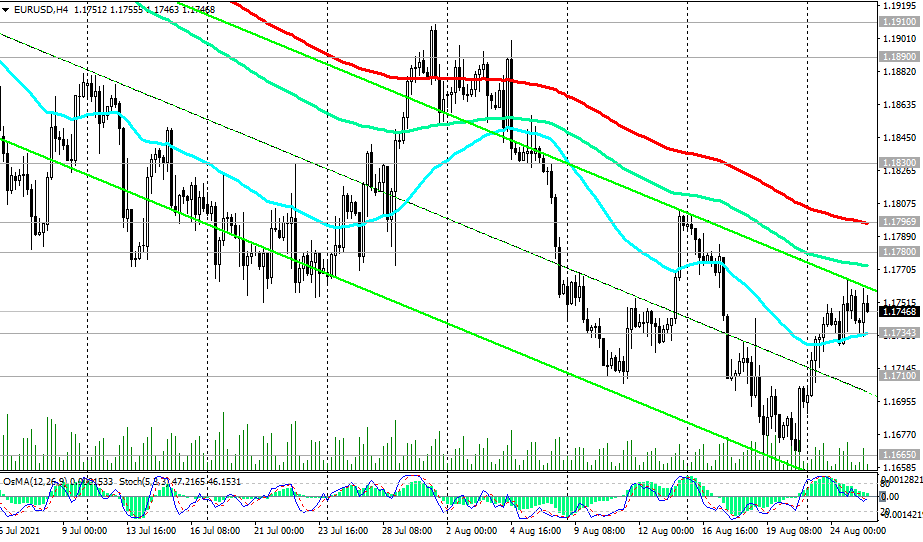

If the corrective growth of EUR / USD continues, then the breakdown of another important short-term resistance level 1.1797 will be a prerequisite for growth towards the resistance level 1.1830 (see also "Fundamental Analysis and Recommendations")

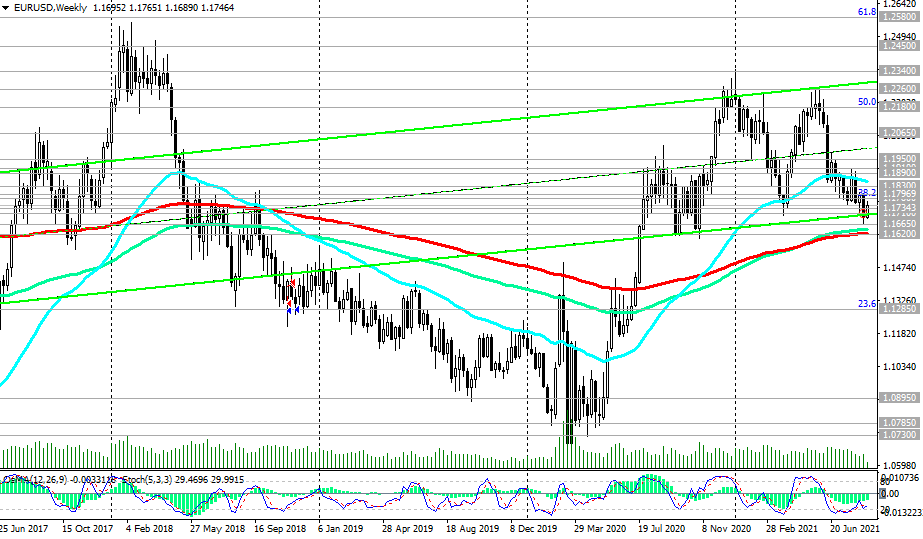

After its breakdown, we should expect further correctional growth towards the key resistance levels 1.1890, 1.1910. In turn, the breakdown of the long-term resistance level of 1.2065 will return EUR / USD to the bull market zone, and the pair may rise to resistance levels of 1.2180 (Fibonacci level 50% of the upward correction in the wave of the pair's decline from the level 1.3870, which began in May 2014, and the highs of 2018 years), 1.2260, 1.2340, 1.2450, 1.2500, 1.2580 (Fibonacci level 61.8%), 1.2600.

In an alternative scenario, and after the breakdown of the local support level of 1.1710, EUR / USD will go deep into the descending channel on the daily chart and towards the long-term support level of 1.1620, the breakout of which will finally return the pair to the zone of the long-term bear market.

Trading Recommendations

EUR / USD: Sell Stop 1.1725. Stop-Loss 1.1770. Take-Profit 1.1710, 1.1665, 1.1620

Buy Stop 1.1770. Stop-Loss 1.1725. Take-Profit 1.1780, 1.1797, 1.1830, 1.1890, 1.1910, 1.1950, 1.2065, 1.2180, 1.2260, 1.2340, 1.2450, 1.2580, 1.2600

*) EUR/USD: Current Fundamental Analysis and Market Expectations

**) the most up-to-date "hot" analytics and trading recommendations (including entries into trades "by-the-market") - https://t.me/fxrealtrading