"Bears" on EUR/USD have been knocking on the door of the 1.18 mark for quite some time now. The impressive spike in consumer prices in the US to 5.4% and Jerome Powell's doubts about the temporary nature of inflation in his speech to the Senate Banking Committee allowed sellers to drop quotes below this level, but they did not manage to stay there for a long time. Will the new attempt at the start of the week of July 23 work? Or if the market does not go where it is expected to be seen, is it more likely to go in the opposite direction?

The US dollar has regained its shine thanks to the June FOMC meeting, but Treasury yields are hindering its continued strengthening. Theoretically, in the event of accelerating inflation and against the background of rapid economic growth, which is now observed in the United States, debt obligations should be disposed of, which will lead to an increase in their profitability. In reality, the opposite process takes place. Profitability is falling, the attractiveness of American assets is declining, and the US dollar cannot play its trump cards properly because of this.

Dynamics of inflation and US bond yields

In fact, there may be several reasons. This includes overly inflated short positions on bonds that are closed as prices rise (yields fall). And the assumptions that inflation and/or GDP have peaked. And higher rates on American debt than on European or Japanese debt. Also, without a rally in US Treasury yields, EUR/USD bears will find it difficult to continue their downward hike.

The ECB can help in this, whose meeting together with the release of data on European business activity are the key events of the week of July 23. Christine Lagarde clearly stated that Frankfurt, unlike Washington, is not going to discuss the exit from the emergency bond-buying during the presentation of the new strategy of the Central Bank of symmetric inflation of 2%. According to her, PEPP will last at least until March 2022 and may move to a new format after that. The ECB does not intend to abandon monetary stimulus until it decides that the phase of the coronavirus crisis is over. Given the WHO announcement of the third wave of COVID-19, date X is shifted indefinitely.

Thus, divergences in monetary policy and economic growth continue to play into the hands of the "bears" on EUR/USD, but the US dollar is hindered by the reluctance of Treasury yields to grow, and the euro may find support in the split in the ranks of the ECB Governing Council and in the strong data on the German and European business activity for July. If this happens, the likelihood of the main currency pair consolidating will increase.

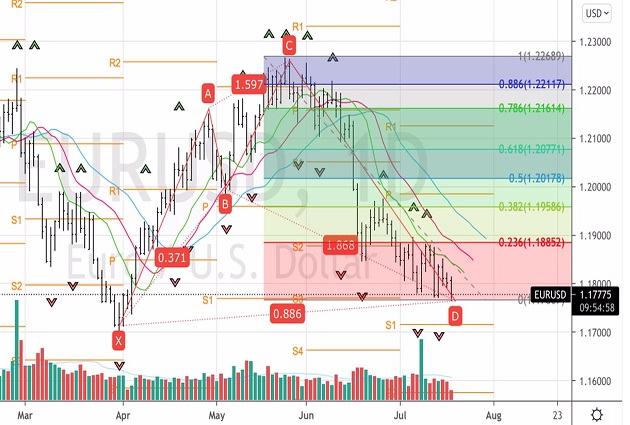

Technically, the implementation of the Harmonic Shark trading pattern with a target of 113%, which corresponds to the level of 1.165, continues on the EUR/USD daily chart. Moving average bounce trading strategy work. We continue to adhere to it. The reason for the sale of the euro against the US dollar may be a confident assault on the support at 1.177.

EUR/USD, Daily chart

https://www.mql5.com/en/signals/1065622