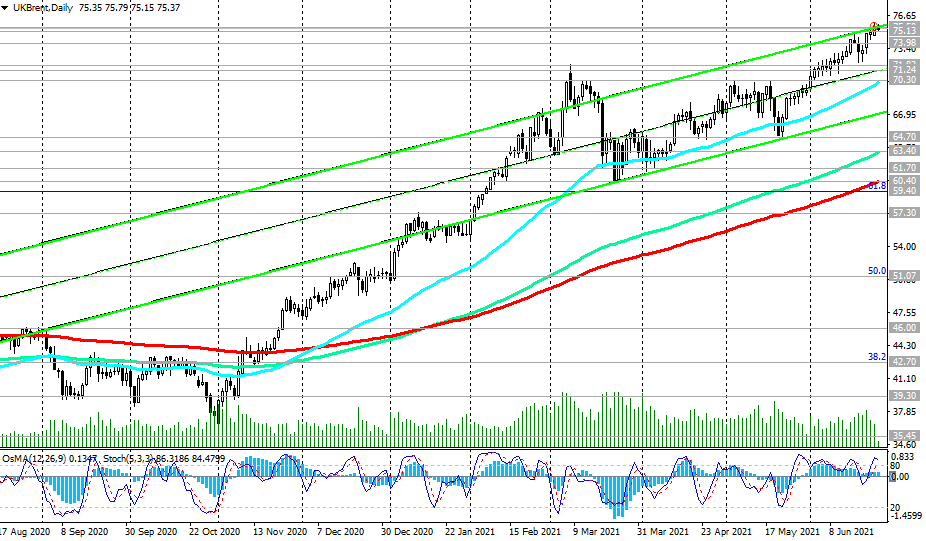

The price remains in the zone of the bull market, above the long-term support levels of 57.30, 59.40, 60.40 and short-term levels of 73.98, 71.24 (see also "Fundamental Analysis and Recommendations")

The breakdown of the local resistance level of 76.00 will cause a further rise in the price towards the local resistance levels of 80.00, 81.00 and the upper border of the ascending channel on the weekly chart passing through the 86.60 mark (October 2018 highs and 100% Fibonacci retracement level before the start of the collapse in price).

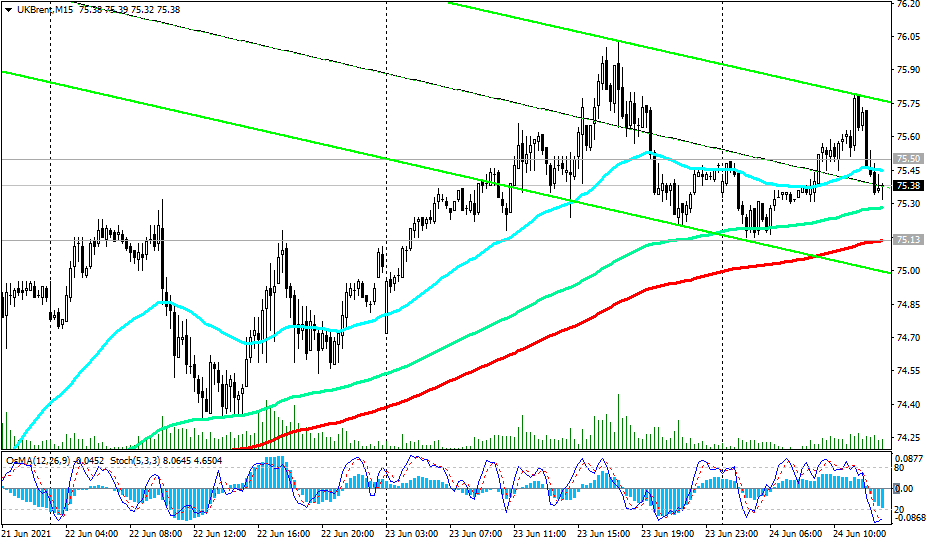

In an alternative scenario and in case of a breakdown of the support level of 70.30, the decline may continue to the levels of 60.40, 59.40, 57.30. A breakdown of the support level of 57.30 will strengthen the negative dynamics and the likelihood of a return to the downtrend. The first signal for the implementation of this scenario will be a breakdown of short-term support levels 75.13, 73.98.

Trading recommendations

Sell Stop 74.90, 73.90. Stop-Loss 76.10. Take-Profit 74.00, 71.82, 71.24, 70.30, 64.70, 63.40, 61.70, 60.40, 59.40, 57.30

Buy Stop 76.10. Stop-Loss 73.90. Take-Profit 78.00, 79.00, 80.00, 81.00, 86.00

*) Brent: Current Fundamental Analysis and Market Expectations

**) the most up-to-date "hot" analytics and trading recommendations (including entries into trades "by-the-market") - https://t.me/fxrealtrading