First, a review of last week’s events:

- EUR/USD. As predicted by most experts (60%), the first half of the week benefited the dollar, strengthening it and dropping the EUR/USD pair to support 1.2050. The US inflation report, released on Wednesday May 12, pointed to an impressive rise in April and hit the stock market hard. The consumer price index climbed 0.8%, the strongest monthly gain since 2009. In annual terms, inflation rose by 4.2% versus 2.6% between March 2020 and March 2021 and showed the strongest acceleration since 2008.

Thanks to this jump, rumors about the possible curtailment of fiscal stimulus programs and an increase in the interest rate on USD began to circulate in the market again.

Risk appetite began to fall, the S&P500 and Dow Jones stock indices went down, and the yield on 10-year US Treasuries moved up.

However, the Fed knows how to restore order in the markets. The regulator explained that this jump in inflation and consumer prices is a temporary phenomenon and is caused in first place by a surge in prices for transport services and used cars. Therefore, the FRS does not intend to either curtail QE programs or raise the interest rate due to the growth of one specific sector of the economy.

The situation turned 180 degrees after such explanations. Trading volumes in the stock markets rose again, reaching the highest values over the past two and a half months. And the European currency won back about 100 points from the dollar, finishing at 1.2143;

- GBP/USD. 100% of trend indicators and 85% of oscillators were pointing north last week. But only 30% of experts agreed that the pair, having broken through the upper border of the channel 1.3670-1.4000, would be able to reach the resistance of 1.4085. But it is them who turned out to be right: - the week's high was recorded on Tuesday, March 11 at 1.4165. The next day, the US inflation report pushed the pair down to the 1.4000 level, which turned from resistance to support. The fall was facilitated by profit-taking on the pound after reaching two-month highs. Then a rebound followed, and the pair completed the five-day period at 1.4096;

- USD/JPY. The forecast for this pair turned out to be quite accurate. Demonstrating an inverse correlation with the DXY dollar index, the yen strengthened on Tuesday May 11, as predicted by 70% of experts, reaching support at 108.35. Then the pair met the expectations of the remaining 30% of analysts and, breaking through the resistance of 109.00, reached a high at 109.78. The last chord of the week sounded at 109.35.

- cryptocurrencies. It seems that the crypto market influencers are only busy trying to destroy it in recent days.

Crypto billionaire Vitalik Buterin knocked Dogecoin clone quotes by an average of 50%. The creators of the meme currencies Shiba Inu, Akita Inu and Dogelon, currying favor with such an authority as Buterin, sent him their coins as a gift, hoping that he would not spend them and give them flattering reviews. However, the creator of Ethereum sent 50 trillion Shiba Inu ($1.2 billion at the time of the transaction) to a fund to help India fight COVID, and donated half of Akita Inu tokens ($ 431 million) on the Gitcoin platform. As a result, all these meme currencies lost about half of their value in just one day.

Facebook founder Mark Zuckerberg also distinguished himself, who shared a photo of two goats, calling one of them Bitcoin. Social media users saw a secret message in this. And some even took offense, deciding that Zuckerberg compared the holders of the main cryptocurrency with these animals. What the billionaire really meant remains a mystery. The price of bitcoin dropped by about $5,000 after the post was published.

However, it was Elon Musk who delivered the biggest blow to the market with his tweet. He expressed concern about "the growing consumption of fossil fuels for mining and transactions on the bitcoin network" on Wednesday and announced that Tesla would no longer accept the cryptocurrency as payment for its cars. The market reacted to this statement with a crushing collapse. In just a few hours, the BTC/USD pair fell by almost 20%, reaching a strong medium-term support level in the $46,600-47,000 zone. Perhaps it would have broken through it too, but the panic was somewhat lowered by Musk's words that Tesla would not sell the previously acquired bitcoin tokens.

Recall that BTC quotes jumped 22% just three months ago on the news that Tesla had invested $1.5 billion in bitcoin and was ready to accept this cryptocurrency as a means of payment. The total capitalization of the crypto market grew more than twice from that moment until May 12: from $1.180 trillion to $2.556 trillion. And now it lost about $437 billion on May 12 and 13. True, the situation began to gradually stabilize by Friday evening, the market grew by $210 billion, and the BTC/USD pair rose to $50,000.

The Crypto Fear & Greed Index fell from 64 to 24 points over the week and is now in the “Fear” zone. According to the index developers, one can think about opening long positions at such a moment. But if you do this, then you should be extremely careful, since, succumbing to panic, investors may continue to sell BTC.

We cited the opinion of JPMorgan Bank experts in our last review that “bitcoin reacts to almost every major fluctuation in the market, which is why its correction begins immediately. Ethereum, on the other hand, has better liquidity and greater resilience to external factors."

The past week has once again confirmed the correctness of this analysis. If bitcoin quotes were at the level of mid-February 2021 on Friday, May 14, Ethereum increased by almost 130% over the same period, having risen from $1,750 to $4,000.

The capitalization of the main altcoin continues to grow as well. The bitcoin dominance index has dropped from 72.65% to 40.55% since the beginning of the year. The share of Ethereum, on the contrary, has increased from 10.79% to 20.52% (maximum of the week). And if the trend continues, then these two cryptocurrencies can take equal positions in the market by the end of July.

***

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. Markets have come to their senses again, realizing that there is still a long way to the start of phasing out the US fiscal stimulus programs. Fed officials are constantly reiterating that it will take several more months of steady growth in employment and inflation before discussing a specific time frame for monetary tightening.

Analysts at BofA Merrill Lynch believe that the behavior of the EUR/USD pair is primarily influenced by what is happening in the United States. However, Europe should not be written off. The Eurozone looks much stronger today than it did a few months ago. Accelerating vaccination rates and reducing quarantine measures suggest an imminent recovery of its economy. The European Commission has already raised its GDP growth forecast for 2021 from 3.8% to 4.3%.

The loyalty of the US Federal Reserve to a soft monetary policy and calmness about the rise in inflation are putting serious pressure on the dollar. Investors will continue to look for how to protect their capital from depreciation due to inflation. The situation in the US stock markets is on the side of the bulls, which will contribute to the weakening of the American currency. However, at the same time we should not forget about the yield on US Treasury bonds, the growth of which, on the contrary, may provide serious support to the dollar.

If we talk about technical analysis, then here the complete advantage is on the side of the green. The growth of the EUR/USD pair is indicated by 70% of oscillators and 90% of trend indicators on H4, and, respectively, 85% and 100% on D1.

But the forecasts of experts do not look so unambiguous. 50% of them believe that the pair will hold out for some time in the side channel 1.1985-1.2180. At the same time, graphical analysis on both timeframes indicates that it will first fall to the lower bound of the trading range.

30% of analysts vote for the fact that this support will be broken, and the pair will drop another 100 points lower. The remaining 20% indicate to the north, to the zone 1.2250-1.2270.

As for the events of the coming week, it is worth noting the data on the GDP of the Eurozone for the first quarter of 2021, which will become known on Tuesday, May 18, as well as the speech of the head of the ECB Christine Lagarde on May 18 and 20. A portion of business activity data in Germany and the Eurozone which will be published on Friday 21 May is also of interest;

- GBP/USD. The oscillator readings on H4 look quite chaotic, but 85% of them point up onD1 as in the case of EUR/USD. The readings of trend indicators are also similar to the previous pair: 90% of trend indicators look north onH4 and 100% on D1.

Most experts expect the pair to start the week in the range of 1.4100-1.4200. However, according to 65% of analysts, supported by the graphical analysis on D1, it will be expected to return to support 1.4000, and in case of its breakdown, it will move to the central zone of the channel 1.3670-1.4000.

As for graphical analysis, it draws the movement in the lateral channel of 1.4000-1.4165 on H4, followed by a breakthrough to the high of February 24 of 1.4240.

As for the macroeconomic statistics of Great Britain, one can single out the publication of data on the labor market on May 18, the consumer market on May 19 and business activity in the services sector of this country on Friday May 20;

- USD/JPY. Most experts (65%) have sided with the bears for the fourth week in a row. Support is at the levels 109.00, 108.35, the target is 107.50. The remaining 35% of analysts expect that the pair will once again try to test the resistance of 111.00. The last time it managed to overcome it more than a year ago, in March 2020.

As for the oscillators on H4, 50% are painted green, 50% are neutral gray. On D1, the neutral position is taken by half as much, 25%. Among the trend indicators, 70% look to the north on H4, and 90% on D1. The graphical analysis readings outline a trading range of 108.85-110.35;

- cryptocurrencies.

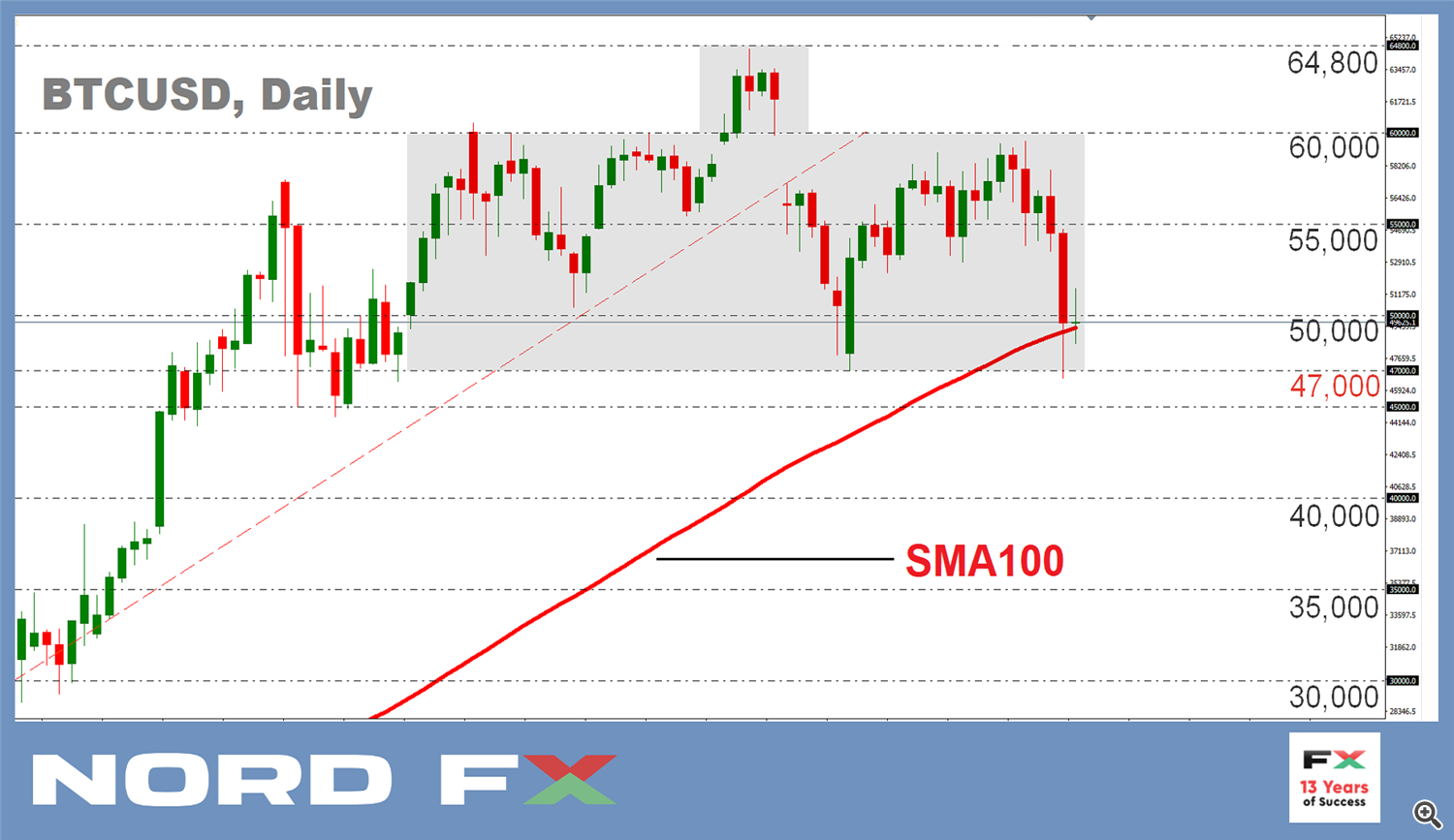

Let's start with technical analysis. The BTC/USD pair has now broken through the 50-day SMA and found a new pivot in the $50,000 zone, where the strong horizontal support and 100-day SMA intersect. However, according to a number of experts, this is where the formation of the right shoulder of the "head and shoulders" pattern is completed, which increases the chances of a breakdown downward, down to the level of $40,000. The next target for the bears is the lows of January 2021 in the $30,000 zone.

The position of Vitalik Buterin and Elon Musk, who seemed to have conspired to support Dogecoin at the peak of the main cryptocurrency, does not add optimism to BTC investors either. The first one clears a place for Dogecoin by dropping the quotes of its competing clones by 50%. The second - refuses to sell Tesla cars for bitcoin, but Musk's SpaceX enters into a partnership with Dogecoin developers by paying for the launch of a new satellite to the moon in this meme currency. Elon Musk even gets the nickname "dogefather."

However, it is clearly premature to say that all the authorities have turned their backs on the main cryptocurrency.

Thus, PlanB, the author of the famous S2FX prediction model for the price of bitcoin, thinks that the coin will continue to rise in price. That is why he replenished his crypto wallet by purchasing BTC on May 8 at the rate of $58,776. Among the arguments in favor of further growth in the price of bitcoin is the growth of reserves of crypto exchanges in dollar stablecoins, which has now reached an absolute maximum of $11.5 billion. Interest in bitcoin is also observed on the part of miners: the hash rate for this cryptocurrency has once again turned out to be at levels that are close to absolute highs.

Analysts of the Whalemap research service presented an analysis of the BTC price dynamics. According to their findings, large investors, including classic companies from the world of finance, continue to buy bitcoins actively. Basing on that, Whalemap believes that the $52,000 price level represents the point below which it will be difficult for the cryptocurrency to leave for a long time. Moreover, as analysts predict, bitcoin can gain a foothold above $60,000 in the foreseeable future.

As for long-term forecasts, Morgan Creek Capital CEO Mark Yusko believes that bitcoin could reach the value of $250,000 within five years. According to the expert, the rapid adoption of the main cryptocurrency will resemble the popularization of Facebook, Apple, Amazon, Netflix and Google. Also, the growth in the value of bitcoin may be affected by the situation in the fiat market, which is now going through hard times.

“At one time, many large companies increased their capitalization to a trillion dollars in 10-20 years. The main cryptocurrency managed to do this much faster. I do not think that cryptocurrencies will start to drawdown sharply in the near future,” Yusko believes. “The market already has a lot of investors who will not leave it until the last.”

At the same time, the head of Morgan Creek Capital did not fail to comment on the dogefather favorite. “However, not all assets are useful and promising,” the financier stated. - Dogecoin, for example, is a joke and a marketing thing for me. It is natural that it is rapidly becoming more expensive after references from Elon Musk. I think this can happen with any coin, even if it has no real value."

The name of the head of Tesla and SpaceX has already sounded many times in the current review - after all, it was his concern about the environment with mining bitcoin that collapsed the market. And it is not at all excluded that after some time bitcoin will split into two coins - "green" BTC, mined from renewable energy sources, and "red", the mining of which strikes a blow on the ecosystem of the planet. But, as it turned out, scammers have already invented a "mining farm" that does not consume any electricity at all.

Police detained two suspects in a Russian small town, who posted an advertisement on the Internet about the sale of a mining farm. One of the villagers responded and transferred 1,000 rubles (about $13) as an advance. After the attackers sent a photo of the package, the future crypto miner sent them the remaining amount. However, taking the parcel from the post office, he found two plastic water bottles and an old fire extinguisher in it. Of course, the chances of getting at least something on such a "farm" are below zero. But if suddenly someone succeeds, it will be the most environmentally friendly cryptocurrency in the world).

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

#eurusd #gbpusd #usdjpy #Forex #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx