The US dollar is declining both on optimism around the expected fiscal stimulus to the US economy, which increases investor risk appetite, and on the coronavirus vaccination.

Today, market participants will closely study the results of the 2-day Fed meeting. The decision on the rate will be published (at 19:00 GMT), and at 19:30 the Fed press conference will begin. Most likely, the Fed will keep its current monetary policy unchanged, given the increased expectations of allocating by Congress a new stimulating package to the economy. The Fed leaders will probably confirm their inclination to conduct extra soft monetary policy, but its parameters will remain unchanged. However, such a decision, practically, has already been taken into account in the prices and quotations of the dollar, and it is unlikely to have a strong impact on the market. Volatility could rise sharply if Fed leaders still make unexpected statements regarding monetary policy.

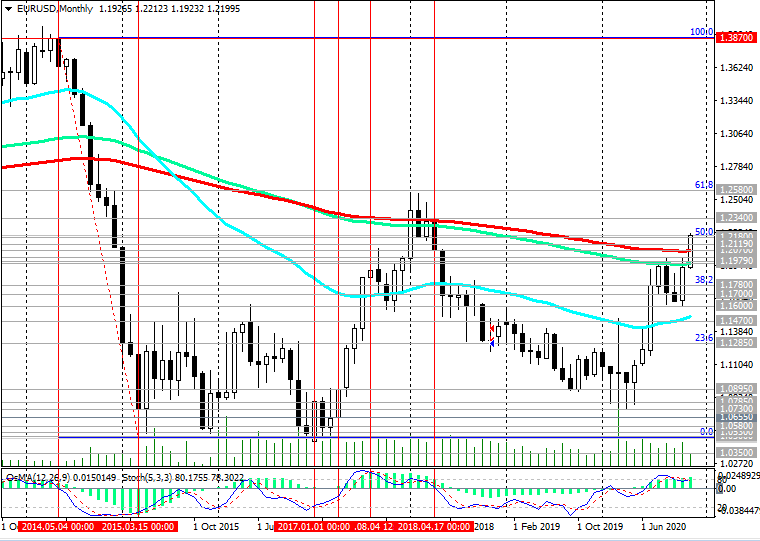

Otherwise, the dollar's tendency to further weakening will continue, and the EUR / USD, which at the time of this article's publication is traded near the 1.2200 mark, will maintain positive dynamics (see "Technical Analysis and Trading Recommendations")

*) for trading, I choose THIS BROKER and use VPS (to receive a bonus, enter the promo code - zomro_17601)