Forex Forecast and Cryptocurrencies Forecast for November 16 - 20, 2020

First, a review of last week’s events:

- EUR/USD. Last week, we started talking about complete uncertainty in the market, when investors just shrug their shoulders, not knowing what to expect in the near future. Yes, Joe Biden has won the presidential election. It seems to have won. Since Donald Trump's team has already collected a lot of facts about the violations and falsifications and is going to challenge the election results in court. For the time being, a number of state bodies, including even the Office of the Director of National Intelligence (ODNI), refused to support the change of president. The distribution of seats in the US Senate remains questionable, and the priorities in the country's policy, including fiscal measures and programs to support the economy, depend on this.

It is completely unclear in which direction and at what speed the situation with the coronavirus pandemic will develop as well. Will there be a new lockdown and of what scale? The daily number of new cases of COVID-19 infection has exceeded 100 thousand in the United States for almost a week and a half already, which requires the adoption of new restrictions at least in some states. And this is a reduction in production, a decrease in the number of jobs and, as a result, a fall in stock indices.

In general, there are still much more questions than answers. And that is precisely why the forecast that we gave last week turned out to be absolutely correct. recall that the opinions of experts were equally divided then: one third voted for the growth of the EUR/USD pair, one third - for its fall, and one third took a neutral position. The nearest levels were named: support - 1.1760, resistance - 1.1965. The EUR/USD pair spent the whole week around these boundaries, fluctuating in the range from 1.1745 to 1.1920, and eventually returned to the Pivot Point zone, along which it has been moving for 16 consecutive weeks. The final chord sounded at 1.1830;

- GBP/USD. Let us start right away with the results of the week - the long-awaited breakthrough did not happen in the Brexit negotiations. And the storms, when the pound, following the forecasts of 70% of experts, first rushed to the north, reaching a height of 1.3315, and then turned southward, falling by 210 points to 1.3105, ended in complete calm in the middle of this range - near the horizon 1.3200;

- USD/JPY. We can state looking at the chart of this pair that those 30% of experts who had sided with the bulls and voted for the return of USD to the 104.00-105.00 zone were right. Following the yield on long-term American securities, the pair even tried twice to break through the resistance at 105.65, but failed, and eventually completed the five-day period at 104.60, climbing 130 points;

- cryptocurrencies. Let's start with the crime news, which did not differ much last week from what had happened before. For example, hackers have reminded of themselves again. This time, Taiwanese laptop maker Compal Electronics fell victim to the ransomware DoppelPaymer. The hackers demanded 1,100 BTC (almost $17 million at the time of writing) for decrypting the files. According to information security experts from Group-IB, DoppelPaymer spreads on Windows networks, is known for attacks on corporate networks by gaining access to administrator rights and was among the three most aggressive and greedy ransomware of 2019.

One more piece of news. The intrigue with the mysterious transfer of bitcoins worth over $1 billion on the night of the US presidential election ended. The most fantastic versions had been put forward, but it turned out later that it was US Department of Justice that had confiscated almost 70,000 BTC from the wallet associated with the Silk Road darkmarket.

Now some statistics. The number of cryptocurrency ATMs has increased by 80% in 2020 compared to their number in 2019. An average of 23 new ATMs are installed every day. Currently, there are about 11 thousand of them in the world, and most of them are located in the United States and Canada. According to experts, most often such ATMs are installed by small startups that are trying to make money on the exchange of cryptocurrency for fiat.

Last week, exchanging bitcoins for dollars became even more profitable, since, as predicted by most experts, the BTC/USD pair crossed the $16,000 mark. The main cryptocurrency rose to a height of $16,460 at its peak, and it happened on Friday 13 - the so-called "day of trouble", which got its name from numerous superstitions and myths and was immortalized in the famous American horror film.

However, as far as Bitcoin is concerned, this day, on the contrary, has delighted many holders of the reference cryptocurrency. Some began to take profits, hoping then to replenish their BTC wallets on a rollback. And those who were not going to sell their coins just got another dose of optimism in anticipating further growth in their capital.

If you look at the chart of the total capitalization of the cryptocurrency market for the last week, you can clearly see that when the BTC/USD quotes fell, active buying of coins began again. This happened both with the price falling to $14,390 on November 07, and the next pullback two days later. As a result, step by step, the pair rose higher and higher, which indicates an overall positive sentiment, and which allowed the total capitalization, as a result, to grow in seven days from $447 billion to $465 billion.

The Crypto Fear & Greed Index was in the same place as a week ago by the evening of Friday, November 13 - at 90, in a zone that the developers of the index designated as "Extreme Greed". This value corresponds to the BTC/USD pair being strongly overbought and portends its correction. Recall that in a similar situation on November 07, the pair lost about 8%. True, it then took less than a day to restore the quotes to the previous values.

As for ethereum, as the Unfolded notes, its dependence on bitcoin has been weakening since the end of October. The correlation of the two largest cryptocurrencies decreases amid preparation for the release of the updated version of the ETH 2.0 network. It is this factor that has accelerated the separation of the main altcoin from BTC. Now the correlation is at its lowest level since early 2018. If ethereum rises in price to $500 in December against the background of weakening bitcoin (now ETH is holding at $460), then it will be able to finally "untie" from its "big brother".

***

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. According to 90% of 65 Wall Street Journal experts, uncertainty in financial markets should decrease with clarity regarding the outcome of the US presidential election and news about the COVID-19 vaccine. Moreover, the head of the ECB, Christine Lagarde, believes that much has become clearer to her personally, thanks to Joe Biden's victory, the expected success in the Brexit negotiations and vaccine development. As a result, the more clarity, the less desire to buy up dollars, and the greater the cravings for riskier assets. And this should lead to the growth of the EUR/USD pair.

But Ms. Lagarde's view is not yet the view of the whole market. The second wave of the pandemic is only gaining momentum. How the United States will behave under Biden's presidency is also unknown. So, for example, 58% of Wall Street Journal experts expect that the size of the next economic aid package will be $1-2 trillion, 29% vote for an amount less than $1 trillion, and the remaining 13% call the figure of $2-3 trillion The continuation and scope of the trade and economic war between Washington and Beijing and many other factors remain in question.

Unlike fundamental, technical analysis doesn't know what presidential elections, trade wars or vaccinations are. That is why, despite the uncertainty prevailing in the market, the indicator readings now look much more specific. Thus, 100% of the trend indicators and 75% of the oscillators on H4 and D1 are painted green. They are opposed by only 25% of the oscillators signaling that the pair is overbought.

But as for analysts, although moods similar to Christine Lagarde's expectations prevail, it is still difficult to call them dominant. The bulls have very little priority: 50% of the experts side with them. Bears have 40% of supporters. The remaining 10% have taken a neutral position.

The narrowest trading range for the pair is limited by the channel 1.1740-1.1845, the next one with the increase in volatility is 1.1700-1.1900, and finally, the maximum swing of fluctuations, since August, is 1.1600-1.2000.

Among the most important economic events of the coming week, the publication of macro-statistics on the US consumer market on Tuesday, November 17 should be noted;

- GBP/USD. Bank of England Governor Speaks Marathon continues, albeit with less tension - if last week Andrew Bailey spoke as many as three times, then for the next one only one of his speeches is scheduled, on Tuesday, November 17th. It is possible to predict with a high degree of probability that the purpose of such public activity of the banker is to convince the government and the public that the regulator has its finger on the pulse and that, despite the difficulties, one should look to the future with optimism.

However, the financier's optimism about the prospects of the British currency is shared by only trend indicators on H4 and D1 and oscillators on H4. But on D1, there is already complete turmoil among the oscillators - one third is colored green, one third is red and one third is neutral gray. This color scheme almost coincides with the forecasts of analysts, among whom 30% are in favor of the growth of the pair, 25% are in favor of its fall, and another 45% take a neutral position. As for the graphical analysis on D1, it definitely leans towards the strengthening of the dollar and the fall of the pound. The supports are 1.3100 and 1.3055, the goal is to return the pair to the echelon 1.2850-1.3000. Resistance levels are 1.3315 and 1.3285.

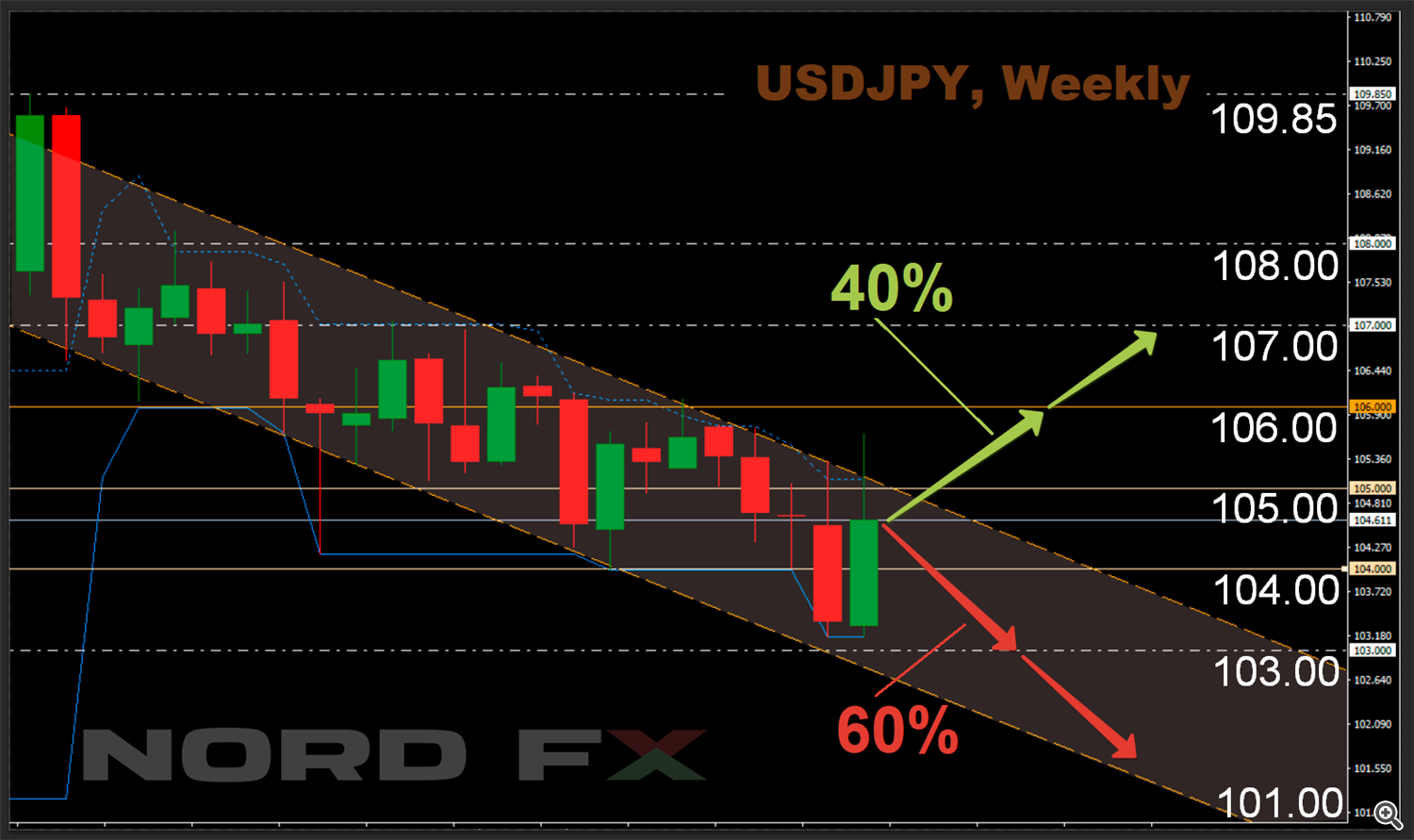

- USD/JPY. It is well known that the dynamics of this pair is greatly influenced by the yield of US securities - where they are, there it is. After falling to the horizon 103.15, the reversal of this pair and the rise to the level of 105.65 looks very impressive. But the result of the week turned out to be not so bright at all, because, after the rise, another fall followed, as a result of which the yen managed to win back more than 40% of its losses.

If you look at the D1 chart, the USD/JPY pair is still within the downlink, which began in the last week of March 2020. And whether it can reverse this trend depends largely on what happens to the real, rather than nominal, yield of 10-year US bonds. And it depends on the policy of the Fed, which, in turn, depends on who will soon be in the White House and what kind of strength awaits us in the Senate of this country.

In the meantime, 60% of analysts, supported by 90% of trend indicators and 70% of oscillators on both timeframes, believe that the pair will keep within the descending channel and will try to test support in the 103.00 zone again. Supports are at 104.35 and 104.00 levels. According to an alternative point of view, the pair is expected to rise first to resistance in the 105.00 zone, and then to a height of 105.65. The next goal is 100 points higher;

- cryptocurrencies. We have already written that the COVID-19 pandemic has become a winning card for bitcoin. The more money Central Banks print, the more investors begin to acquire bitcoin as a protective asset. But this card is not the only one. Many representatives of the crypto sphere were encouraged by the results of the US presidential election, where Joe Biden may have won. The crypto community believes that, unlike Donald Trump and his Treasury Secretary Steven Mnuchin, Biden will be more liberal about digital currencies and the blockchain industry in general. However, the issue of Biden's reigning in the White House has not yet been resolved, as Trump intends to prove numerous irregularities during the vote in the courts. So this “Big Game” has not yet ruled out big surprises.

Bloomberg analyst Mike McGlone believes that the bitcoin rate will rise to at least $20 thousand in 2021 and renew its all-time high. This is not McGlone's first positive prediction. In early October, he suggested that the first cryptocurrency would rise in price to $100,000 by 2025 and gave several reasons for this. These include the monetary policy of the states, which leads to the depreciation of fiat currencies.

Former associate of George Soros in the Quantum fund billionaire Stanley Druckenmiller agrees with McGlone, he also expects the dollar to fall on the horizon of three to four years. He revealed in an interview with CNBC that he invested some of the capital in the first cryptocurrency, while admitting that bitcoin may be a better tool for preserving value than gold.

A sharper growth curve for BTC/USD is predicted by a popular blogger under the nickname PlanB. So, if according to Mike McGlone's forecasts, the first cryptocurrency will reach $100 thousand only by 2025, PlanB expects to see it at this height by December 2021. The expert notes that during periods of market corrections, he observes how the algorithms of bitcoin whales pick up hundreds of portions of 0.01 BTC from "weak hands". Later these coins “disappear” in “deep” cold vaults. According to the S2F model, this move of bitcoins to wallets for long-term storage leads to a reduction in their sales. This is especially true for the period after the halving, which leads to a supply shock and provokes a bull market for the next 18-20 months. This was the case for the first and second halving of miner awards in 2012 and 2016. According to PlanB, the dynamics of bitcoin after the third halving in May 2020 is developing like clockwork, which once again confirms he is right.

At the moment, the BTC/USD pair has reached the highs of January 2018. But mass profit-taking is holding back greed in anticipation of its growth to at least $20,000. Especially since there are no serious levels of resistance along the way. However, global factors, such as Trump's victory or mass vaccination against COVID-19, as well as Chinese miners who have relaunched their equipment and need cash money to cover capital expenditures and operating expenses, may reverse the trend.

60% of experts expect the BTC/USD pair to be fixed above the $17,000 level by the end of November. 20% give a neutral forecast, and the remaining 20% expect the pair to fall to the $14,000-15,000 zone.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.