In the FX, the US dollar eased against most of its G10 counterparts and demand in yen, Swiss franc and US treasuries rose. The US 10-year yield retreated to 0.64%.

Long euro remains the consensus view against a soft US dollar, as the European recovery story remains operational with no alarming sign of a rise in new coronavirus cases. The European nations accelerate business reopening, and there is a firm belief that the 750-billion-euro fiscal aid package will get approval shortly and give another boost to the single currency. Therefore, price retreats below the 1.12 mark could be interesting deep buying opportunities for traders trading the euro recovery story, as long as the pair remains above the critical 1.1160 Fibonacci retracement (major 38.2% on April – June recovery). The latest CFTC data confirms a further rise in net speculative positions in euro.

Cable consolidates losses below its 100-day moving average (1.2395). The sterling risks remain tilted to the downside on Brexit uncertainties, although the fact that the decision deadline has been pushed to October is a relief for short-term traders. The upside potential will likely remain capped near the 200-day moving average, 1.27.

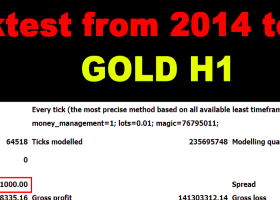

Lingering risks across the global risk markets and sliding sovereign yields continue pushing capital into gold. The price of an ounce advanced past $1770 on Monday, after rebounding from the $1750 mark last Friday. The $1750 level is now a critical support for oil traders, though the 50-day moving average ($1722) should be a solid safety net in case of an unexpected break below this support.

By Ipek Ozkardeskaya