(20 March 2020)DAILY MARKET BRIEF 1:Volatility eases as central banks and governments deploy more stimulus.

The S&P500 advanced 0.47%, the Dow added 0.95%, as Nasdaq surged 2.30% in New York, as the Trump administration proposed more fiscal help

including tax rebates up to $1200 per person, but more importantly, emphasized that more help is on the way.

WTI recorded a historical

one-day rally of 24% on Thursday. The barrel of black gold recovered to $28 and stabilized above the $25 in the overnight trading session.

A

deluge of direct fiscal aid finally had a positive effect on the market mood, along with the massive monetary interventions including

significant interest rate cuts, huge cash injections and the announcement of substantial asset and CP purchases.

It has been weeks since

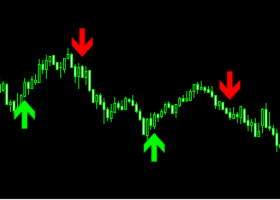

we haven’t seen a 1%-2% trading range in US equities. A short decline in volatility doesn’t necessarily mean that the panic is over, but it is

an encouraging sign that we may have approached a bottom. Yet we need to see a further decline in volatility and price stabilization before

crying victory.

central banks and governments, blue-chip companies now step in to take proactive measures to temper the negative impacts

of the coronavirus tragedy on their activity and finances. In this context, Ford announced to suspend its dividend and fully rely on $15.4

billion from two credit lines in an effort to provide itself more flexibility for its finances and investments this year. Ford’s share price

jumped more than 8% as investors backed the company’s tactical move to navigate the shaky waters.

By Ipek Ozkardeskaya