(16 FEBRUARY 2019)WEEKLY MARKET OUTLOOK 1 :US Data Keeps Coming On The Soft Side

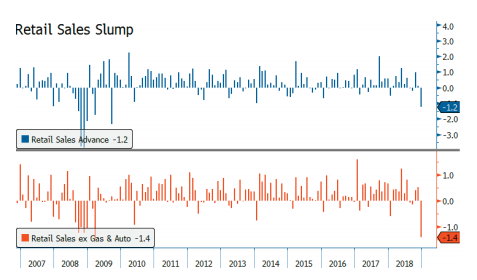

Over the last few days, the greenback has been trading with an upward bias, remaining insensitive to the publication of economic data – good or bad. Indeed, the trade negotiation between the US and China remains the main driver in the FX market. The release of both January’s inflation data in the US and December retail sales didn’t affect much market participants. Headline inflation eased to 1.6%y/y - compared to 1.9% in the previous month and forecast of 1.7% - amid a collapse of oil prices during the first month of the year. Nevertheless, the core measure, which excludes the most volatile components, came in above forecast, printing at 2.2%y/y compared to 2.1% expected, which suggests that the underlying trend remains unchanged. However, geopolitical developments will remain at centre stage for now as investors continue to try to assess collateral damages from the China/US conflict on global growth. In addition, the Fed has switched to full “wait-and-see” mode and should maintain that stance through 2019, at least. Nevertheless, last week’s main surprise came from US consumers. The publication of December’s retail sales figures, which has been delayed by one month due to the shutdown, came as a stark reminder that the economic situation is not rosy anymore. Retail sales contracted 1.2%m/m in December versus +0.1% expected and a downwardly revised figure of 0.1% in November. This is the largest contraction since September 2009. Similarly, the gauge that excludes automobiles and gasolines sales slumped 1.4%m/m compared to forecast of +0.4% and +0.5% in November. Several factors could explain such a collapse of retail sales. Firstly, the government shutdown that started on December 22nd definitely sparked cautiousness among consumers but also deprived civil servants of their income.

Secondly, the December market sell-off was violent enough to remind both investors and consumers that a recession is still a live possibility. Therefore, consumers most likely increased saving at the expense of spending over the last few weeks. The poor US data triggered some volatile moves but failed to set a clear trend. Even though we believe that the US economy is slowing, we anticipate it will take time for investors to acknowledge the new environment. Indeed, more data a needed to validate such a narrative.

By Arnaud Masset