Last Wednesday, the Bank of Canada left its key interest rate unchanged, at 1.75%. In a statement explaining the decision to leave interest rates unchanged, a much more cautious tone is used than in previous statements. On Thursday (13:50 GMT) Bank of Canada Governor Stephen Poloz will deliver a speech. The soft rhetoric of Stephen Poloz regarding the bank’s monetary policy will further weaken the Canadian dollar.

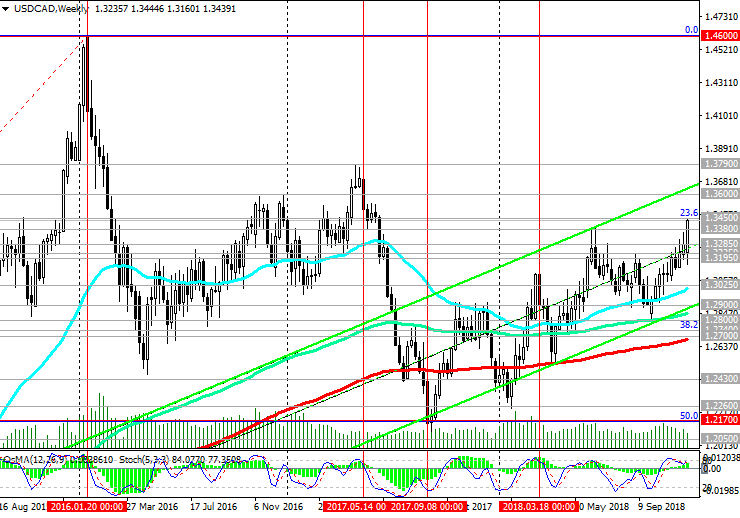

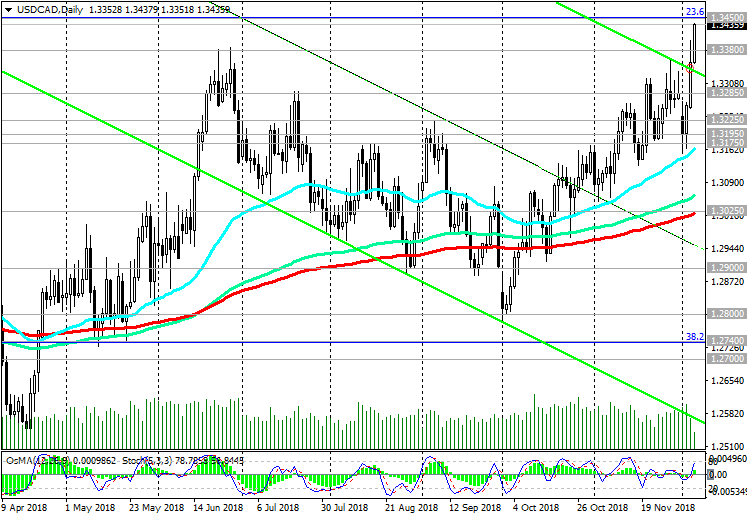

USD / CAD maintains a positive trend, trading in the ascending channel on the weekly chart, the upper limit of which is above the resistance level of 1.3600. Above the key support level of 1.3025 (ЕМА200 on the daily chart) a bullish trend remains.

In case of breakdown of the resistance level 1.3450 (Fibonacci level 23.6% of the downward correction to the growth of the pair in the global uptrend since September 2012 and 0.9700).

The growth targets will be the resistance levels of 1.3600, 1.3790 (2017 highs). Long positions are preferred.

Only a breakdown of support levels 1.2740 (Fibonacci level of 38.2%), 1.2700 (EMA200 on the weekly chart) will cancel the bull trend.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support Levels: 1.3380, 1.3300, 1.3285, 1.3225, 1.3195, 1.3025, 1.2900, 1.2800, 1.2740, 1.2700

Resistance Levels: 1.3450, 1.3600, 1.3790

Trading Scenarios

Sell Stop 1.3370. Stop-Loss 1.3460. Take-Profit 1.3300, 1.3285, 1.3225, 1.3195, 1.3025

Buy Stop 1.3460. Stop-Loss 1.3370. Take-Profit 1.3600, 1.3790

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

![[$9,496] in 5 Days Using 'Supply Demand EA ProBot' (Live Results) [$9,496] in 5 Days Using 'Supply Demand EA ProBot' (Live Results)](https://c.mql5.com/6/965/splash-preview-761070-1740062258.png)