Major US stock indexes continue to decline, receiving a negative impulse at the beginning of the week from the speech of the head of the Fed, Jerome Powell.

As you know, during his first official speech before Congress on Tuesday, Powell drew a very positive picture of the state of the American economy, confirming the Fed's intention to gradually tighten monetary policy.

"Economic prospects remain strong. A further gradual increase in the rate of federal funds will best contribute to the achievement of the goals of the Fed", in his opinion.

Jerome Powell said that the Fed "will continue to seek a balance between avoiding overheating of the economy" and the achievement of annual inflation of 2%. Many investors considered Powell's speech as a signal to the Fed intending to hold 3 interest rate increases planned at the December meeting. Some market participants felt that the Fed could implement even 4 increases instead of the previously planned 3 increases. According to CME, the probability of 4 rate increases this year is estimated by investors at 34%. On Monday, this probability was 24%, and a month ago - 23%.

The tightening of monetary policy negatively affects the dynamics of the stock markets, since it leads to an increase in the cost of borrowing. Investors in this case prefer the dollar as a more reliable form of investment in comparison with highly risky assets.

On Friday, the major US stock indexes are down for the fourth consecutive day.

On Thursday, President Donald Trump, who announced that next week he will approve the plan to introduce new import duties on steel and aluminum by 25% and 10%, respectively, contributed to this decline. Market participants are afraid of accelerating inflation and slowing the growth of US GDP due to new import tariffs. From China and Europe, statements from the authorities have already followed that they will take counter measures to protect their interests.

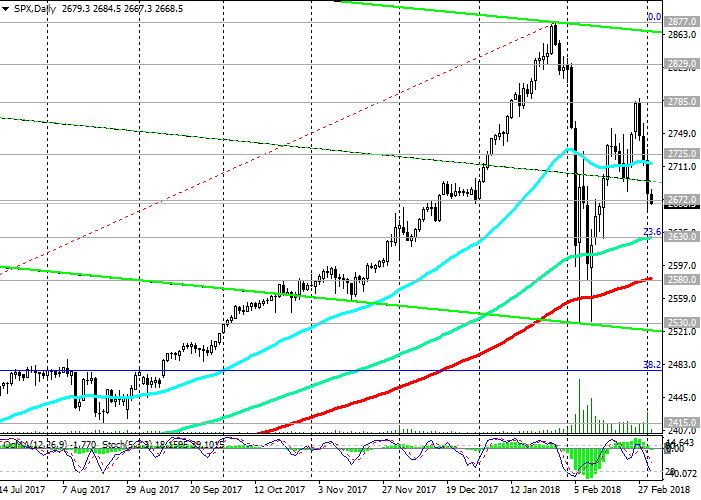

Since the beginning of the week, the DJIA dropped 3.3% to 24510.0 points, the S & P500 fell 3.1% to 2670.0 points. Thus, DJIA for 2018 decreased by 0.4% and the S & P500 - by 0.2%, again moving into the correction zone. European stock markets also fell. STOXX Europe 600 fell 1.3%, German DAX fell 2.0%, and the British FTSE and French CAC fell 0.8% and 1.1%, respectively.

World trade wars have not brought long-term benefits to anyone. The yield of 10-year US government bonds fell to 2.802% from 2.870% on Wednesday, showing the most significant drop since September and indicating that investors are buying safer assets.

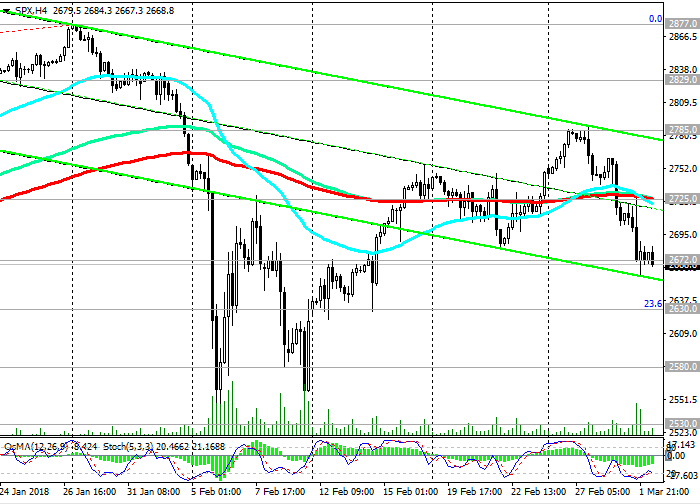

Today, important news on the US is not expected. It is likely that the stock indexes, including the S & P500, will finish today's trading session in negative territory. While the S & P500 is below the short-term resistance level of 2725.0 (200-period moving average on 1-hour and 4-hour charts), it is necessary to consider only short positions with objectives at support levels 2630.0 (Fibonacci level 23.6% of the correction to growth from February 2016 and EMA144 on the daily chart), 2580.0 (EMA200 on the daily chart).

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 2672.0, 2630.0, 2580.0,

2530.0

Resistance levels: 2725.0, 2785.0, 2800.0, 2829.0, 2877.0, 2900.0

Trading Scenarios

Sell in the market. Stop-Loss 2686.0. Objectives 2630.0, 2614.0, 2585.0, 2530.0

Buy Stop 2686.0. Stop-Loss 2665.0. Objectives 2725.0, 2785.0, 2800.0, 2829.0, 2877.0, 2900.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com