FTSE100: The Bank of England decided to keep the current interest rate at the same level

Today was a busy day of publication of important macro-economic news. After the Swiss National Bank decided to leave the deposit rate at -0.75%, the franc declined in the foreign exchange market. According to the NBS, "the franc remains highly overvalued", and currency interventions with the franc's sales are still "necessary".

At 11:00 (GMT), the decision of the Bank of England was published, according to which the central bank of Great Britain decided to keep the current interest rate at the previous level of 0.25%, the lowest level for the last 300 years.

Contradictory data from the UK, published recently, including high inflation, improvement in the labor market and increased production activity, but weak wage growth, made it necessary for the Bank of England not to rush to make a decision on changing monetary policy.

The pound reacted to the Bank of England's decision by strengthening, while the London Stock Exchange index declined. Two of the 9 members of the Bank of England's Monetary Policy Committee (MPC) voted for an immediate increase in the interest rate amid accelerated inflation, which hit British incomes, which also reflected a decline in consumer spending.

The UK economy is focused on the domestic market, and the decline in consumer spending negatively affects the growth of the country's GDP.

Nevertheless, the UK economy against the backdrop of Brexit still requires support in the form of maintaining a soft monetary policy.

The propensity of some members of the Bank of England's Monetary Policy Committee (MPC) to tighten monetary policy gives rise to an opinion among economists that the Bank of England may soon begin to phase out the extra soft monetary policy.

Some economists expect that early next year, the Bank of England will gradually increase the cost of borrowing.

And this is a negative factor for the British stock market, and a positive one for the pound.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and

resistance levels

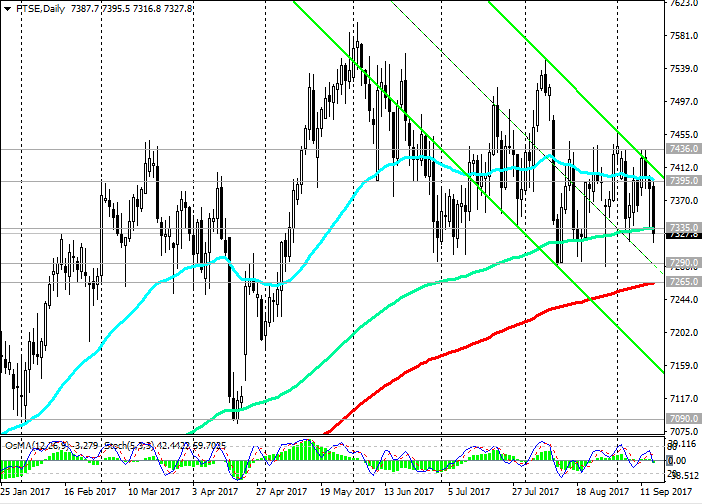

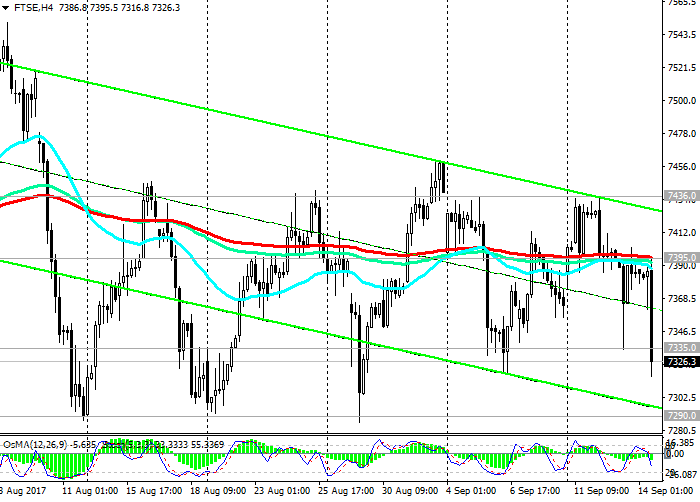

In response to the decision of the Bank of England on the rate, the FTSE100 index fell sharply, failing to develop an upward trend above the resistance level of 7395.0 (EMA200, EMA144 on the 4-hour chart).

Immediately after the publication of the decision, the FTSE100 index within half an hour decreased by 0.8% to support level 7335.0 (EMA144 on the daily chart).

Indicators OsMA and Stochastics on the 4-hour, daily and weekly charts were deployed to short positions.

If the negative dynamics will increase, then the nearest targets of reducing the FTSE100 will be support levels of 7290.0 (summer lows), 7265.0 (EMA200 on the daily chart).

The breakdown of the support level of 7265.0 will accelerate the decline of the index within the descending channel on the daily chart, the lower limit of which passes near the support level of 7090.0 (the low of February, the highs of October).

Breakdown of the level 7090.0 and further decline will mean a turn and end of the upward trend of the FTSE100 index.

The scenario for the resumption of growth implies the return of the FTSE100 index above the local resistance level of 7436.0.

While the Bank of England maintains an extra soft monetary policy, the scenario for the preservation and development of the bullish trend remains relevant.

Support levels: 7335.0, 7290.0, 7265.0, 7200.0, 7090.0, 7050.0

Resistance levels: 7395.0, 7400.0, 7436.0, 7450.0, 7500.0, 7600.0

Trading Scenarios

Sell on the market. Stop-Loss 7410.0. Take-Profit 7290.0, 7265.0, 7200.0, 7090.0, 7050.0

Buy Stop 7410.0. Stop-Loss 7290.0. Take-Profit 7436.0, 7450.0, 7500.0, 7600.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com