The Swiss National Bank has traditionally stated that the Swiss franc is overbought, consistently advocating a soft monetary policy in the country.

As a result of the efforts of the Swiss National Bank aimed at curbing the growth of its currency, its foreign exchange reserves grew to about 700 billion francs (735 billion US dollars). However, investors continue buying francs.

The Swiss franc, along with gold, the yen, is often used by investors as an asylum during periods of economic and political instability, thanks to Switzerland's strong economy, low levels of its debt and the stability of its political system.

Nevertheless, for the export-oriented Swiss economy, the franc's exchange rate is extremely important. A large share of its exports falls to the Eurozone, China, the United States, and the rising franc leads to a rise in the price of Swiss goods, making them less competitive.

Realizing this, the NBS seeks to contain the growth of its national currency.

The Swiss National Bank has set a negative deposit rate, hoping that this will reduce the attractiveness of Swiss assets for international investors.

Also, the NBS periodically conducts currency interventions with franc sales, of which it never declares either before or after the intervention.

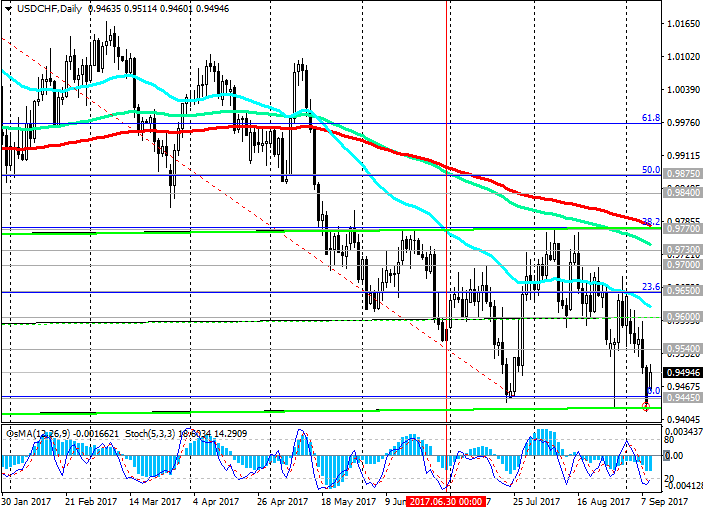

At the end of July, the pair USD / CHF reached the level of 0.9445, after which its sharp, unexplained growth began, while the dollar was actively declining in the currency market against other major currencies. It is likely that the Swiss National Bank conducted a currency intervention. As a result, the USD/CHF grew by about 3.5%, reaching 0.9770 in August.

Today, USD/CHF is again trading near the level of 0.9445, from which the pair started to grow at the end of July.

On Thursday, a meeting of the NBS on monetary policy will take place, and at 08:30 (GMT) the NBS's decision on the interest rate, which at the moment is (-0.75%), will be published.

It is necessary to be extremely cautious when opening short positions for a pair of USD/CHF, since unexpected decisions from the NBS are possible on the background of the newly strengthened franc.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

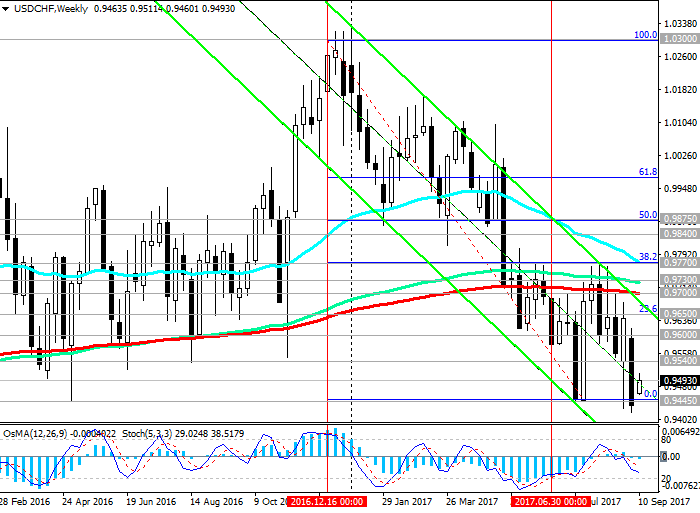

After reaching the annual low at 0.9445 at the end of July, the pair USD / CHF skyrocketed during several trading sessions and reached the level of 0.9770 in the middle of last month (Fibonacci level 38.2% of the upward correction to the last global wave of decline since December 2016 and from the level 1.0300).

Nevertheless, in the future, the pair USD / CHF again moved into a downtrend against the background of a large-scale falling dollar.

Today, trading opened with a sharp increase in the dollar in currency pairs with the yen, the franc, as well as the decline in gold prices. Probably, this was due to the fact that the DPRK did not start the missile once again, as it was expected on September 9, when the anniversary of the founding of the state was celebrated.

Nevertheless, the pressure on the dollar persists. It is not excluded that already today during the American session the pair USD / CHF decline will resume.

You also need to be careful on the eve of the NBS meeting this week. Unexpected decisions on the part of the NBS or new currency interventions with franc sales are possible, which will cause another sharp growth of the USD / CHF.

In this case, technical analysis fades into the background under the pressure of fundamental factors.

The first signal to the growth of USD / CHF will be the breakdown of the short-term resistance level 0.9540 (EMA200 on the 1-hour chart). In this case, the growth targets will be the resistance levels 0.9600 (EMA200 on the 4-hour chart), 0.9650 (the Fibonacci level of 23.6% of the upward correction to the last global decline wave since December 2016 and the level of 1.0300) 0.9700 (EMA200 on the weekly chart), 0.9770 (EMA200 on the daily chart and the Fibonacci level of 38.2%).

In the case of the breakdown of the level of 0.9400, the decline in the pair USD / CHF may resume within the descending channel on the daily chart. The lower boundary of this channel passes near the support level of 0.9300. This level will become the goal if the USD/CHF is resumed.

The strong negative dynamics prevails.

Support levels: 0.9445, 0.9400, 0.9300

Resistance levels: 0.9540, 0.9600, 0.9650, 0.9700, 0.9730, 0.9770

Trading Scenarios

Buy Stop 0.9520. Stop-Loss 0.9460. Take-Profit 0.9600, 0.9650, 0.9670, 0.9690, 0.9730, 0.9770

Sell Stop 0.9460. Stop-Loss 0.9520. Take-Profit 0.9400, 0.9300

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com