The sharp increase in EUR / USD, observed from the beginning of the year and, especially, in recent days, is connected both with the weakening of the dollar and with the continuing purchases of the euro. Heads of the Fed and the ECB did not make any hints at the last conference in Jackson Hole about the timing of further interest rate hikes. Investors regarded this as the Fed's tendency to soft monetary policy and that the current euro rate is satisfied with the ECB leaders.

Since the beginning of this year, the trade-weighted index of the euro has increased by more than 7%. This was the best result for the currency since its inception in 1999.

The single European currency receives support and against the backdrop of strengthening the economy of the Eurozone, which is often mentioned by the head of the ECB Mario Draghi. Euro since the beginning of the year it has added more than 14% against the dollar. The pair EUR / USD has reached the maximum mark since January 2015.

In the minutes of the July meeting of the ECB, there were "concerns about the rise in value (euro) in the future". Nevertheless, many economists believe that the ECB will begin to wind down the bond purchase program in December this year. The ECB simply does not have assets to buy.

At the same time, the ECB is in a difficult situation, since inflation is below the target level of just under 2.0%. Still, the ECB is likely to have to roll back the stimulus even if the outlook for inflation worsens.

In view of this, it is likely that the euro will continue to grow. Much will depend also on the pace at which the ECB will begin to reduce purchases of assets.

Today we are waiting for the data from the USA. Starting at 12:15 (GMT) a number of important macroeconomic indicators will appear, including the report on employment from ADP for August, data on spending on personal consumption in the US for the second quarter, annual GDP for the second quarter. In this period, a surge in volatility is expected in trading in financial markets, including the EUR / USD pair, which should be taken into account when opening trade positions at this time.

The GDP is expected to grow by 2.7% (against + 2.6% in the first quarter). If the forecast is justified, the dollar will receive support. Meanwhile, the prospect of further weakening of the USD and the growth of the EUR / USD pair remains.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

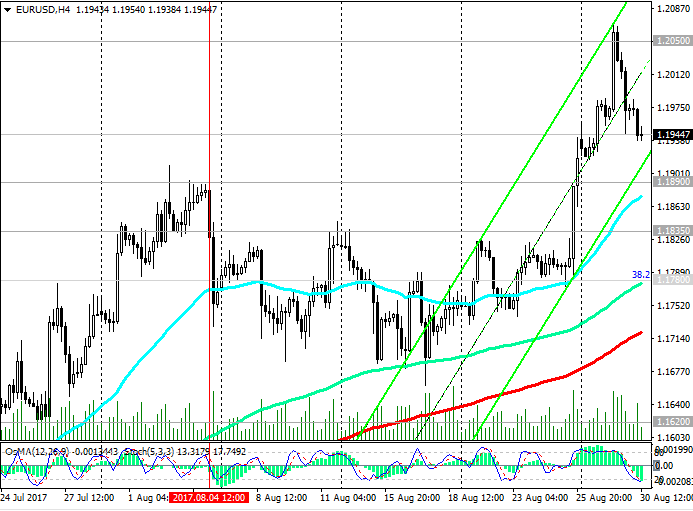

Despite the current corrective decline, the pair EUR / USD keeps positive dynamics, trading in the uplink on the daily chart.

Yesterday EUR / USD set another 4-month record, reaching 1.2070 and returning to the levels of December 2014.

If the growth resumes, the targets will be the levels of 1.2050 (low of July 2012), 1.2070, 1.2180 (the Fibonacci level of 50% of the corrective growth from the minimums reached in February 2015 in the last wave of global decline from 1.3900), 1.2370 (EMA200 on the monthly chart).

You can return to consideration of short positions in case of EUR / USD return to support level 1.1780 (Fibonacci level 38.2%). The breakthrough of support level 1.1620 (EMA200 on the weekly chart) increases the risk of EUR / USD returning to a downward global trend.

Support levels: 1.1890, 1.1835, 1.1780, 1.1720, 1.1670, 1.1620

Resistance levels: 1.2050, 1.2070, 1.2100, 1.2180

Trading Scenarios

Sell Stop 1.1920. Stop-Loss 1.1985. Take-Profit 1.1890, 1.1835, 1.1780, 1.1720, 1.1670, 1.1620

Buy Stop 1.1985. Stop-Loss 1.1920. Take-Profit 1.2050, 1.2070, 1.2100, 1.2180

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com