The consumer price index (CPI) of the UK in July compared with July last year increased by 2.6% (the forecast was + 2.7%). Thus, according to the data presented today, in July the annual rate of consumer inflation did not change with respect to June. But the annual growth rate of purchasing prices of producers in July slowed sharply - to 6.5% from 10% in June.

As a result of the sharp weakening of the pound after the referendum on Brexit in May, consumer price inflation accelerated to a maximum of 2.9% in mid-2013. Against the background of the weakening of the pound, the purchasing power of the British sharply decreased, which sharply limited their spending.

Retail sales are one of the main "fillers" of British GDP. The slowdown in inflation favorably influences the British economy, which is oriented primarily toward the domestic market. Improving the situation in the service sector for consumers, which has recovered due to strong retail sales, contributes to GDP growth in the UK. So, according to official data released last Wednesday, in the second quarter, the British economy grew by 0.3% after rising 0.2% in the 1st quarter.

The pound declined after the publication of today's data on inflation, but the British stock index FTSE rose, indicating the favorable impact of slowing inflation on the growth of the British economy. Yet the main risk for the UK economy remains Brexit.

For today (at 12:30 GMT) it is planned to publish important data from the US - inflation indicators for July (retail sales), as well as import-export price indices.

High level of retail sales will strengthen the US dollar. Forecast: + 0.4% (against -0.2% in June).

The weak values of the indicators will put pressure on the dollar, which is now recovering in the foreign exchange market after it became known that the DPRK leader Kim Jong-un decided not to attack Guam after consulting with the military command. This was also facilitated by China's decision to support the sanctions against Pyongyang imposed by the United States.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

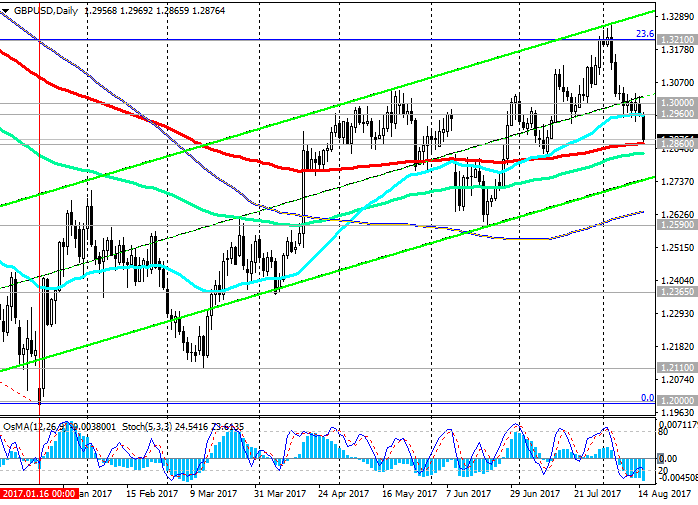

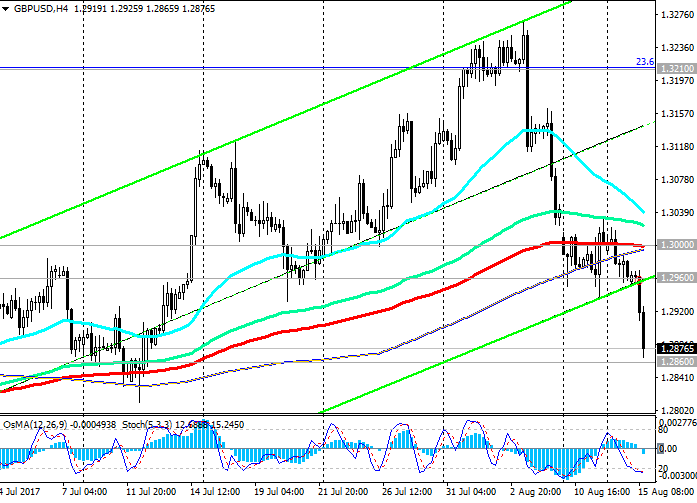

The pair GBP / USD broke through the important short-term support levels of 1.3000 (EMA200 on the 4-hour chart), 1.2960 (EMA50 on the daily chart, the bottom line of the uplink on the 4-hour chart) and is rapidly declining to the key support level 1.2860 (EMA200 on the daily chart).

Break of this level will speak about the completion of the upward correction and will strengthen the risks of GBP / USD returning to a downtrend.

The alternative scenario is connected with the return of GBP / USD to the zone above the level of 1.3000 and the resumption of growth. The closest target in this case will be resistance level 1.3210 (Fibonacci level 23.6% correction to the decline of the GBP / USD pair in the wave, which began in July 2014 near the level of 1.7200). Levels of 1.3300 (the upper limit of the channel on the weekly chart), 1.3460 (July and September highs) will be the next target.

So far, the downward trend is dominating, as evidenced by the indicators OsMA and Stochastics, which on the 1-hour, 4-hour, daily and weekly charts turned to short positions.

Support levels: 1.2860, 1.2800

Resistance levels: 1.2960, 1.3000, 1.3100, 1.3210, 1.3300, 1.3400, 1.3460

Trading Scenarios

Sell Stop 1.2850. Stop-Loss 1.2910. Take-Profit 1.2815, 1.2765, 1.2700, 1.2640, 1.2590, 1.2550, 1.2365

Buy Stop 1.2910. Stop-Loss 1.2850. Take-Profit 1.2960, 1.3000, 1.3100, 1.3210, 1.3300, 1.3400, 1.3460

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com