As expected, the Bank of Japan has upheld its monetary policy, while once again lowering the forecast for inflation. Now, the Bank of Japan expects that inflation will reach 2% around 2019 fiscal year, that is a year later than previously forecast. Last month, the Bank of Japan did not begin to change its monetary policy, retaining the aggressive incentive program, which represents the purchase of government bonds by about 80 trillion yen per year (720 billion US dollars), as well as maintaining the target yield of 10-year Japanese bonds around 0% and maintaining a short-term rate of -0.1%. This decision was expected by the majority of market participants and economists.

The economy of Japan shows growth, albeit at a modest pace. However, inflation fluctuates near zero levels against the central bank's target level of 2%.

During today's press conference, the Governor of the Bank of Japan Haruhiko Kuroda called the target level of 2% "world standard". "This level is necessary to maintain a stable exchange rate", Kuroda said and reiterated that the Bank of Japan continues to adhere to this target level.

The lower inflation forecasts indicate the likelihood that the Bank of Japan will not change its monetary policy, although other central banks are inclined to tighten it, in the foreseeable future. The Japanese yen may decline due to tightening of monetary policy in other economically developed countries, which reduces the attractiveness of the yen for investors. The Japanese yen can still be in demand, but only as a safe haven.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

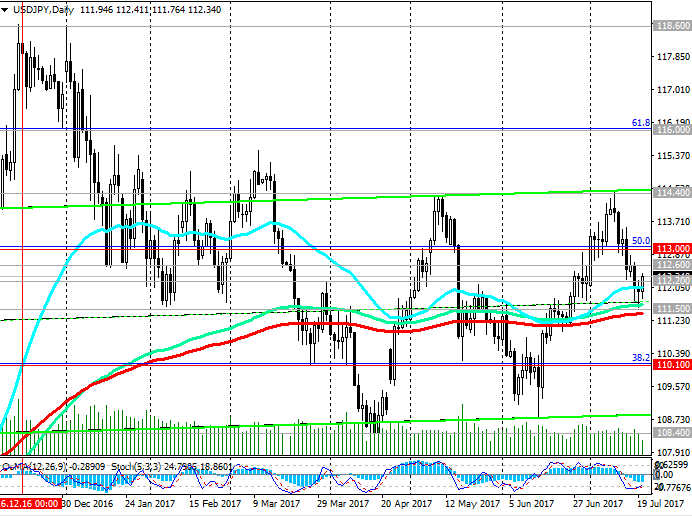

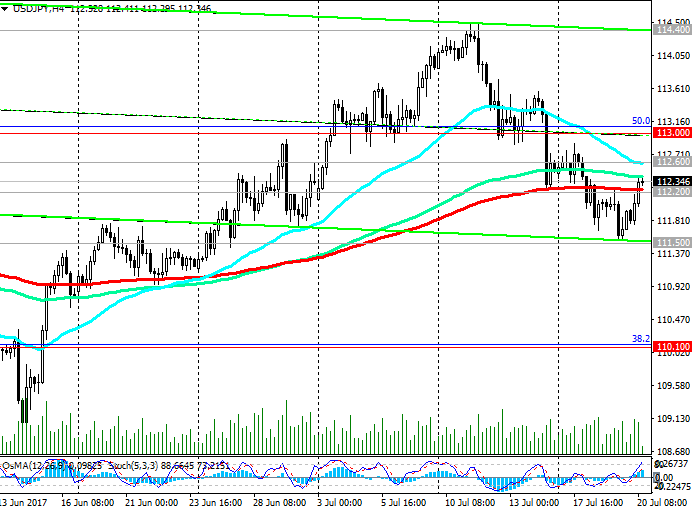

Not having reached the key support level 111.50 (ЕМА200, ЕМА144 on the daily chart), the pair USD / JPY has grown today after the publication of the decision of the Bank of Japan. The pair USD / JPY broke through the important short-term resistance level 112.20 (EMA200 on the 4-hour chart). In case of breakdown of one more important level of resistance 112.60 (EMA200 on the 1-hour chart), the pair USD / JPY growth may continue to the upper boundary of the range between the levels 114.40 and 108.40. If the pair USD / JPY can gain a foothold above 114.40, then its growth may continue with the targets 116.00 (Fibonacci level 61.8%), 118.60 (December and January highs), 121.30 (highs in January 2016) against the background of the difference in monetary policy of the Fed and Bank of Japan.

Nevertheless, against the backdrop of the long-term bullish trend of the pair USD / JPY periods of active downward correction are highly probable, when the demand for yen rises in periods of geopolitical and financial instability.

The reverse scenario involves a breakdown of the support level of 111.50 and a further decline in the pair USD / JPY with the target of 110.10 (Fibonacci level of 38.2% of the correction for the pair growth since August of last year and the level of 99.90), 108.40 (the lower bound of the range).

Support levels: 111.50, 111.00, 110.10, 109.00, 108.40, 108.00, 106.50

Resistance levels: 112.60, 113.00, 114.40, 115.00, 116.00

Trading Scenarios

Buy Stop 112.50. Stop Loss 111.90. Take-Profit 113.00, 114.40, 115.00, 116.00, 117.00, 118.60

Sell Stop 111.90. Stop Loss 112.50. Take-Profit 111.50, 111.00, 110.10, 109.00, 108.25, 106.50

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com