(10 JULY 2017)DAILY MARKET BRIEF 2:Yen set to weaken on continued Fed normalization path

That is a good news for the Bank of Japan, investors are estimating the likelihood of another US rate hike much higher which is driving the yen currency lower. The US ZIRP (zero-interest rate policy) seems to approach to an end. The rate differential between the US yields should then increase.

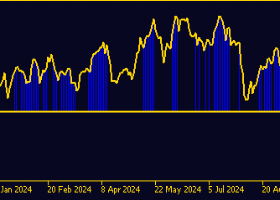

The spread between US 10-Y and Japan 10-Y is now widening. The US is now whistling the end of the free money era and Japan which has been struggling to fight against deflation may now have a unique occasion to see its inflation running back again.

For the time being, Japan fundamentals data are still on the soft side. This morning May machine orders declined by 3.6% m/m after the fall of 3.1% in April. The USDJPY is now monitoring its highest level in a year and we believe that in the absence of geopolitical uncertainties, the JPY should further weaken. The summer promises to be quiet for the BoJ.

By Yann Quelenn