Several fundamental factors that occurred this week contributed to the pound's weakening in the foreign exchange market. According to polls conducted on the eve of June 8, when early parliamentary elections will be held in Great Britain, the support of the ruling Conservative Party, led by Prime Minister Teresa May, declined.

In the middle of last month Teresa May unexpectedly announced early parliamentary elections. The purpose of these elections is to ensure the dominant position of the Conservative Party in the parliament on the eve of the June elections, in order to agree with the EU on more favorable conditions for Brexit. If the Conservative Party has more seats in the parliament, this will neutralize the influence of the supporters of the tough scenario Brexit.

However, among investors, there is growing doubt about the development of this scenario.

Another negative factor for the pound was the terrorist attacks in Britain, where explosions during the concert were blown up this week at the stadium in Manchester. Theresa May raised the level of the terrorist threat to a critical one.

From the side of the macro data, a portion of the negative also arrived. According to the data published yesterday, UK GDP growth for the first quarter was revised downward (+ 0.2% instead of 0.3%, + 2.0% instead of + 2.1% in annual terms, as reported in the first GDP estimate).

Thus, the pound was among the leaders of the fall this week. The GBP / USD pair seems to be closing this week with a decline of almost 1.0% or about 130 points.

From the news for today, we are waiting for data on the United States. At 12:30 (GMT) important macroeconomic indicators will be published: the adjusted value of the GDP index for the first quarter, orders for durable goods for April. If the value of GDP (the second estimate) is revised upward, the dollar will strengthen in the foreign exchange market, including in the GBP / USD pair. This will be another argument in favor of raising the interest rate in the US at a meeting of the Fed on June 13-14.

Conversely, if the indicators come out weaker than expected, this will lead to a decrease in the dollar. Today is Friday, the end of the last full trading week of the month. At the end of the US trading session, it is possible to fix short positions on the dollar, which can cause the dollar to rise and decline against it other major currencies, including the pound.

Support and resistance levels

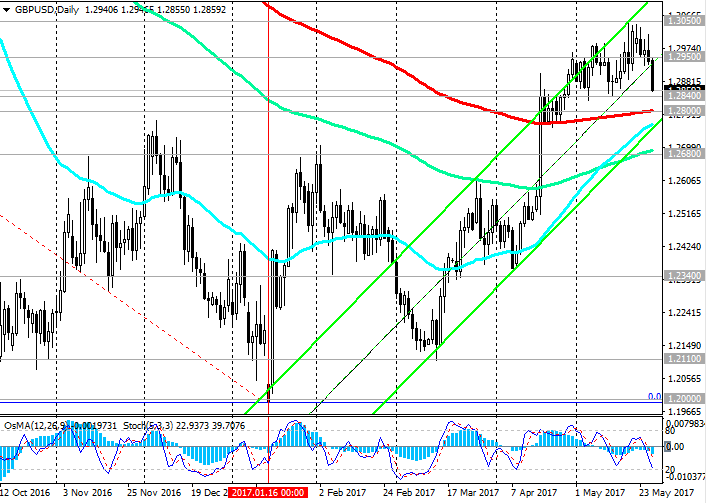

The pair GBP / USD broke through the short-term support level of 1.2950 (EMA200 on the 1-hour chart) and falls to support level 1.2840 (EMA200 on the 4-hour chart). A little lower, at 1.2800 there is another strong support level of 1.2800 (EMA200 on the daily chart).

In the case of an increase in negative dynamics and breakdown of support levels of 1.2700 (bottom line of the upward channel on the daily chart), 1.2680 (EMA144 on the daily chart), the upward trend of the pair, which began in January 2017, could grow into a downtrend.

Indicators OsMA and Stochastics on the 4-hour and daily charts went to the side of sellers.

On the weekly chart, the indicators also unfold to short positions.

You can return to consideration of long positions for the GBP / USD pair after its return to the zone above the level of 1.2950. In case of breakdown of the local maximum near the 1.3050 mark, the GBP / USD pair growth will resume within the upward channel on the daily chart. The closest target will then be the level of 1.3210 (Fibonacci level of 23.6% correction to the decline in the GBP / USD pair in the wave, which began in July 2014 near the level of 1.7200).

Support levels: 1.2790, 1.2680, 1.2590, 1.2485, 1.2340, 1.2110

Resistance levels: 1.2990, 1.3000, 1.3100, 1.3210

Trading Scenarios

Sell in the market. Stop-Loss 1.2955. Take-Profit 1.2840, 1.2800, 1.2680, 1.2590, 1.2485, 1.2340

Buy Stop 1.2955. Stop-Loss 1.2890. Take-Profit 1.2990, 1.3050, 1.3100, 1.3210

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics