As it became known, during the two-day meeting, the Fed kept interest rates at the same level, in the range of 0.75% -1.00%. The decision was taken unanimously, by 9 votes out of 9.

The leaders noted the observed slowdown in US economic growth since the beginning of the year, but characterized it as having a "temporary nature." The decision of the Fed was expected. Now, market participants with a probability of 75% expect a rate increase at the June meeting of the Fed (June 13-14).

The dollar responded with growth to the decision of the Fed and continued to increase after the publication of the decision. Despite the fact that yesterday the EUR / USD fell by 4%, losing almost 100 points, today the EUR / USD pair has fully recovered at the beginning of the European session.

Portion of positive from the Eurozone in the form of macroeconomic statistics, received at the beginning of the European session, allowed the euro to strengthen its position in the foreign exchange market.

Retail sales in the Eurozone in March, according to updated data, increased by 0.3% (+ 2.3% in annual terms). Data on retail sales for February were also revised upwards: to + 0.5% (+ 1.7% in annual terms). The composite index of purchasing managers (PMI) of the Eurozone for April was revised upwards to 56.8 from 56.7. In March, the index was 56.4, and in April reached a 6-year high.

During yesterday's European trading session (at 09:00 GMT), data on the Eurozone's GDP (preliminary value) for the first quarter were published. The GDP growth was + 0.5% (+ 1.7% in annual terms), which coincided with the forecast.

It is unlikely that the data presented will have an impact on the leadership of the ECB, which considers the growth of the Eurozone economy still weak enough to begin curtailing the QE program in the Eurozone. Unemployment in the Eurozone remains at 9.5%, while inflation is still below the ECB's target level (just under 2.0%).

As you know, at the end of last month, the ECB kept interest rates at the same level (the ECB's main interest rate is 0%, the deposit rate for commercial banks is negative and is -0.4%). As the head of the ECB, Mario Draghi, stated at the next press conference, "the incoming data strengthen our confidence that the observed economic growth will continue to strengthen and expand," however, "the risks ... are still shifted downwards, and they are connected, first of all , with global factors ".

Today (at 16:30 GMT) ECB President Mario Draghi will start the speech. Volatility in EUR trades could rise sharply in the course of his speech. Mario Draghi is able to unfold the markets, especially if his speech touches on the subject of the monetary policy of the ECB.

Support and resistance levels

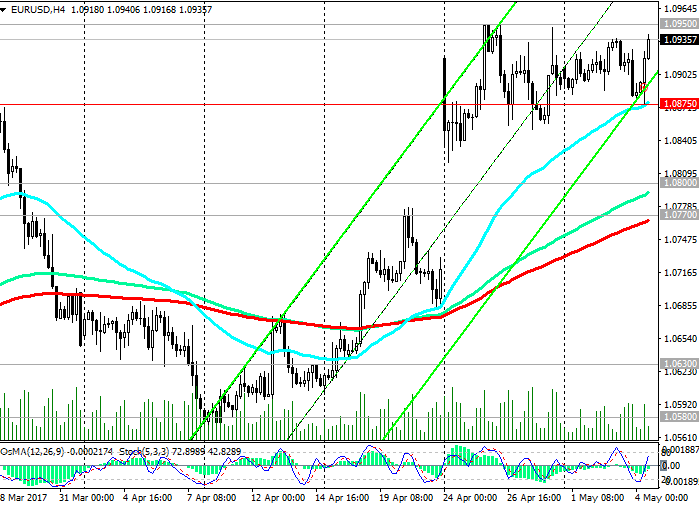

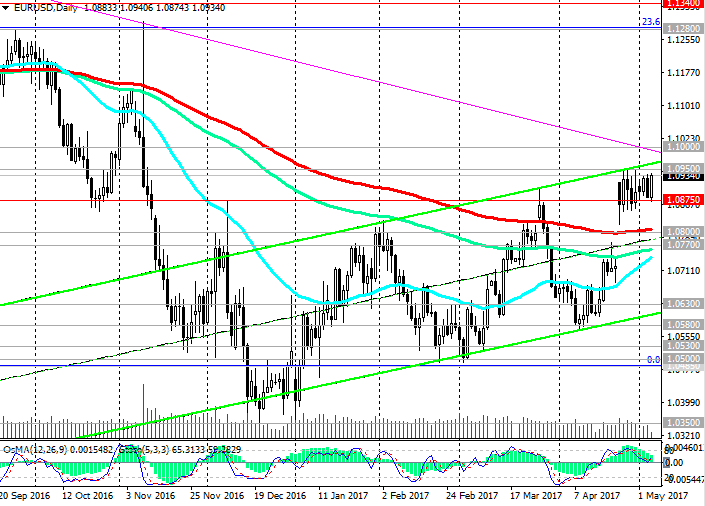

After the first round of the presidential elections in France, the pair EUR / USD continues to remain in the range, mainly between the levels of 1.0850, 1.0950. The EUR/USD is also above the short-term support level 1.0875 (EMA200 on the 1-hour chart).

Positive short-term dynamics of the EUR / USD pair prevails above this level, as evidenced by the OsMA and Stochastic indicators on 1-hour, 4-hour, daily, weekly charts.

Also above the support level 1.0800 (EMA200 on the daily chart), medium-term positive dynamics is also preserved. The EUR/USD is at the top of the rising channel on the daily chart, its upper limit runs between the levels of 1.0950, 1.1000.

The recent positive macroeconomic data from the Eurozone stimulate the growth of the number of euro buyers. If on Sunday Macron wins the final victory in the second round of the presidential elections in France, then the euro's positions will significantly strengthen in the currency market, including the EUR / USD pair.

In case of breakdown of the levels of 1.0950, 1.1000, the pair EUR / USD may go to resistance levels 1.1280 (Fibonacci level of 23.6% of corrective growth from the minimums reached in February 2015 in the last wave of global decline from 1.3900), 1.1340 (EMA144 on the weekly chart).

An alternative scenario for a reduction in the medium term will become relevant if the EUR / USD pair returns to the support level of 1.0800. The targets for the decline will then be levels 1.0770 (EMA144 on the daily chart), 1.0630 (bottom line of the uplink on the daily chart), 1.0580 (April lows), 1.0530, 1.0500.

Development of such a scenario will also contribute to the systematic implementation of the decisions of the Fed on a gradual increase in the interest rate in the US and a reduction in the balance of the Fed.

Support levels: 1.0875, 1.0850, 1.0800, 1.0770, 1.0700, 1.0630, 1.0580, 1.0530, 1.0500

Levels of resistance: 1.0950, 1.1000, 1.1200, 1.1280, 1.1340

Trading Scenarios

Sell Stop 1.0870. Stop-Loss 1.0910. Goals 1.0850, 1.0800, 1.0770, 1.0700, 1.0630, 1.0580, 1.0500

Buy Stop 1.0960. Stop-Loss. Goals 1.1000, 1.1200, 1.1280, 1.1340

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics