EUR/USD Risks Near-term Exhaustion Heading into NFPs

Talking Points

- EUR/USD testing near-term resistance ahead of NFPs

- Updated targets & invalidation levels

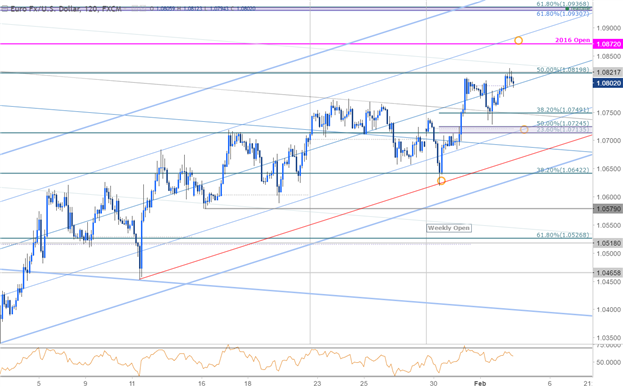

EUR/USD 120min

Technical Outlook:EURUSD has continued to trade within the confines of this ascending pitchfork formation extending off the December / January lows with the advance testing confluence resistance today at 1.0820- this level is defined by the 50% retracement of the November decline & the March low. Note that the pair has been marking bearish divergence into these highs and further highlights the risk for a near-term pullback in price.

Interim support rests at 1.0750 backed by 1.0713/24. If Euro is indeed heading higher, losses should be limited to the lower parallel / 1.0642 (bullish invalidation). A breach of the highs targets subsequent topside objectives at the 2016 open at 1.0872 backed by 1.0930/37. U.S. Non-Farm Payrolls are expected to come in at 175K for the month of January with unemployment widely expected to hold at 4.7%. From a trading standpoint, I would be looking lower heading into the release with a drop into the lower parallels to be viewed as a buying opportunity.

EURUSD Speculative Sentiment Index

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are short EURUSD- the ratio stands at -2.05 (~32% of traders are long)- bullish reading

- Long positions are 8.1% lower than yesterday and 22.0% below levels seen last week

- Short positions are 7.9% higher than yesterday and 29.7% above levels seen last week

- Open interest is 2.0% higher than yesterday and 15.5% above its monthly average

- While the current SSI profile continues to point higher for the euro, it’s worth noting that the recent narrowing in the ratio as price approaches resistance leaves the advance vulnerable near-term. That said, look for a continued build in short-exposure in the coming days to further support the long-bias.

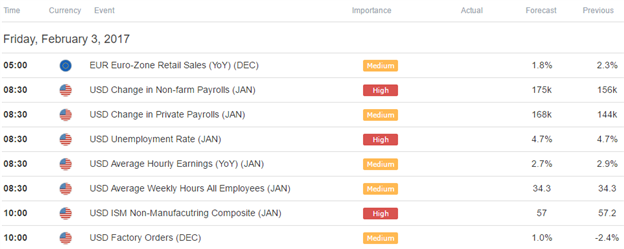

Relevant Data Releases