Crude Oil Prices May Extend Gains on Inventories Drawdown

Talking Points:

- Crude oil prices soars as API data amplifies OPEC news-flow

- Gold prices left range-bound despite hawkish Yellen comments

- EIA oil inventories data, year-end flows in the spotlight ahead

Crude oil posted the largest daily increase in three weeks after API inventory data amplified supportive OPEC news-flow. The report pointed to a drawdown of 4.15 million barrels last week. The official EIA report set to cross the wires in the coming hours is expected to show a more modest 2.43 million barrel drawdown. An upside surprise echoing the API assessment may offer prices a further upside nudge.

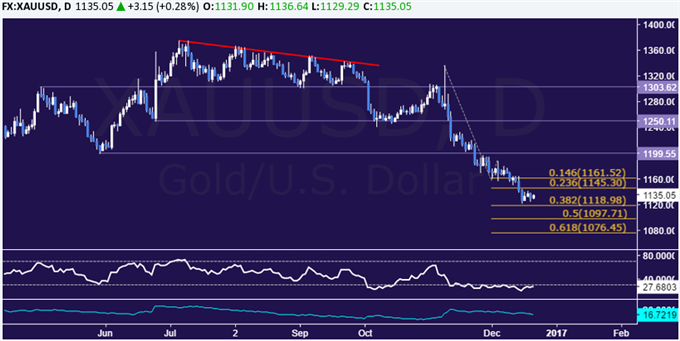

Meanwhile,a modest pullback courtesy of Fed Chair Yellen failed to gain enough momentum to pull gold prices out of a narrow consolidation range staked out after prices hit a ten-month low last week. A lull in headline event risk and thinning pre-holiday liquidity conditions may open the door for a correction of "Trump trade" moves, hinting at the possibility of a bounce driven by profit-taking.

GOLD TECHNICAL ANALYSIS – Gold prices continue to tread water above the $1100/oz figure. From here, a break below the 38.2% Fibonacci expansion at 1118.98 on a daily closing basis targets the 50% level at 1097.71. Alternatively, a turn back above the 23.6% Fib at 1145.30 exposes the 14.6% expansion at 1161.52.

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices look set to test monthly resistance above the $54/bbl figure. Breaching the 54.63-55.00 area (38.2% Fibonacci expansion, trend line) on a daily closing basis exposes the 50% level at 56.08. Alternatively, a reversal below the 23.6% Fib at 52.84 targets the 23.6% expansion at 51.73.