Trading recommendations

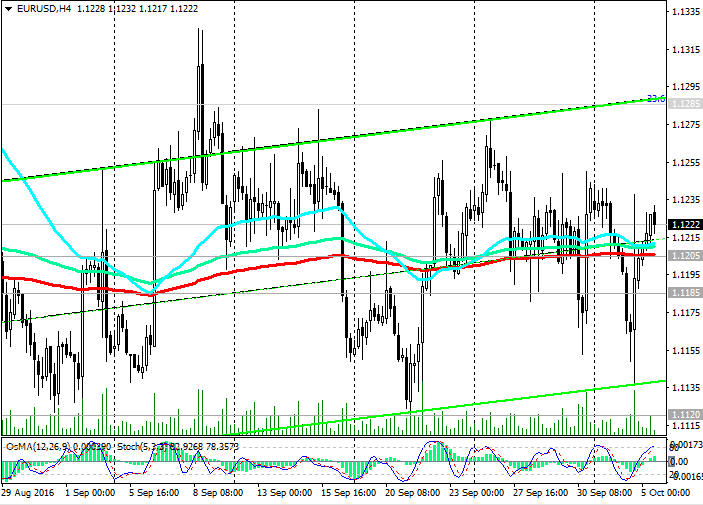

Sell Stop 1.1190. Stop-Loss 1.1225. Targets 1.1120, 1.1045, 1.0975

Buy Stop 1.1240. Stop-Loss 1.1205. Targets 1.1285, 1.1350, 1.1400, 1.1430, 1.1485, 1.1535

Technical analysis

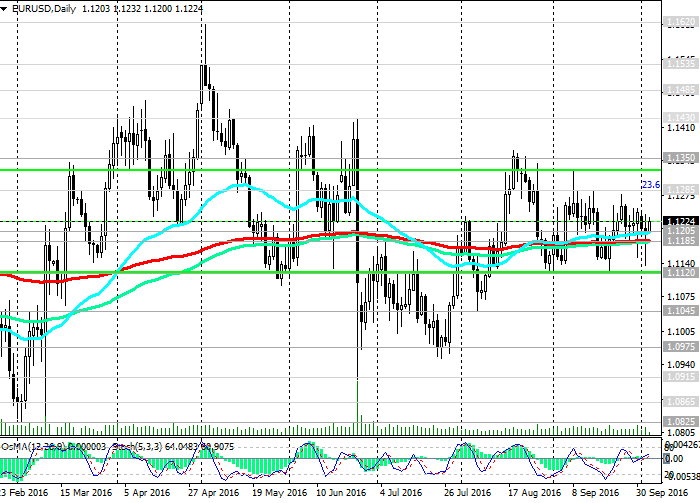

The positive momentum of the EUR / USD today is preserved and pushing EUR / USD pair to the upper limit of the range and level of 1.1285 (Fibonacci 23.6% retracement level of the last wave decline from the highs of 2014). Yesterday posts by agency Bloomberg News that the ECB may be gradually reduce the purchase program bonds triggered the strengthening of the euro on the currency market.

Today the EUR / USD upward momentum is developing, maintaining support at 1.1205 (short term balance line, expressed EMA200 on 4-hour chart). On the weekly chart has formed a new downstream channel with a lower limit, passing below the level of 1.0710 (at least one year).

The last three months of movement of the pair EUR / USD is mainly in the range between the levels of 1.1430, 1.0975. Narrower bands formed in August. They are located between the levels of 1.1350, 1.1045 and 1.1120 levels between 1.1285 and. The median line and balance line - level 1.1185 (EMA200, EMA144 on the daily chart).

Today is expected to publish a number of important macroeconomic indicators in the US, which can set the tone for today's dynamic dollar and the euro on the currency market.

Indicators OsMA and Stochastic on the 4-hour, daily, weekly charts recommend long positions.

The attention of investors is gradually switched to Friday. At 15:30 (GMT + 3) will be published key data (labor market) in the US in September. Break of 1.1285 resistance level 1.1350 and the upper limit of the range will increase the risks of further growth of the pair EUR / USD. In case of breakdown of support levels and lower range limits 1.1120, 1.1045 can be developed to reduce the reverse scenario couples.

Different directions Fed's monetary policy and the ECB will put pressure on the EUR / USD pair in the medium term.

Support levels: 1.1205, 1.1185, 1.1120, 1.1045, 1.0975, 1.0915

Resistance levels: 1.1285, 1.1350, 1.1400, 1.1430, 1.1485, 1.1535

Appeared in the press reports that the ECB was considering folding quantitative easing, called yesterday a sharp rise in the euro on the currency market. The EUR / USD soared yesterday an hour on 80 points, above the level of 1.1235, after the agency by Bloomberg News it was reported that the ECB may be gradually reduce the purchase program bonds. In response to the euro strengthened in the forex market against most currencies. If a positive impetus to the euro continues, the pair EUR / USD may continue to rise towards the top of the range and level of 1.1285 Fibonacci 23.6%.

Additional support for the EUR / USD pair had statements Chicago Fed President Charles Evans today. He said that the probability of increasing the key interest rate the Fed remains very low. According to him, the Fed can let the economy overheat and that inflation returned to a desired level. If inflation is clearly closer to the Fed set the target level of 2%, then the Fed will move to raise rates. "We must get clear and convincing evidence that inflation is close to 2%", - said Evans.

Today published very good macroeconomic indicators for the Eurozone. The index of business activity in the services sector in September for the euro area published by Markit Economics, assessing the business climate in the euro area services sector rose to 52.2 (vs. 52.0 forecast). A result above 50 strengthens the euro and says the growth in this sector of the euro area economy. In Germany, whose economy is the first largest in the euro area, the figure in September also rose to a value of 50.9.

From the news today forward data from the US. At 15:15 (GMT + 3) will be presented data on the number of people employed in the United States (the report on employment from ADP) in September in the private sector. Reduction is expected at 11,000 the number of employees in the private sector of the US (166,000 against 177,000 in August), which may adversely affect the dollar. At 15:30 published data the US trade balance for August, at 16:45 - the business activity index in the services sector PMI for September by Markit Economics, assessing the state of sales, employment, as well the forecast for the development of the sector of services. At 17:00 published PMI index of business activity in the US services sector in September from the ISM, as well as the level of production orders in the US in August.

It is necessary to pay more attention in this period of time in view of the expected increase in the volatility of trading in the currency market.

Author signals - https://www.mql5.com/en/signals/author/edayprofit