EUR/JPY Technical Analysis: BoJ Brings Range Support

Talking Points:

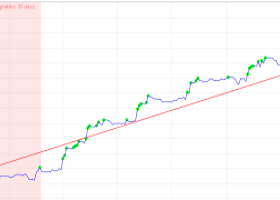

- EUR/JPY Technical Strategy: Long-term down-trend, intermediate-term range-bound with recent move down to support.

- EUR/JPY has stayed within a 450-pip range for the past month and a half, and this compression of volatility may be preluding a ‘big’ move in the not-too-distant future.

- If you’re looking for trading ideas, check out our Trading Guides. And if you want something more short-term in nature, check out our SSI indicator. If you’re looking at opening a trading account, FXCM has a contest at the beginning of each month for certain account holders. Click here for full details.

In our last article, we looked at the continue range in EUR/JPY with price action working a Fibonacci retracement from the ‘Brexit range’ on the pair that had seen numerous support and resistance inflections. But as we advised, an upcoming BoJ decision had the potential to add considerable volatility to the mix with a strong probability of the range finally giving way.

And while that BoJ announcement did bring on considerable volatility in the Yen, but this merely brought in prior range support in EUR/JPY. The zone of support around the 112-handle is interesting as there are at least three different mechanisms of support at work around this level. At 112.02 we have the 23.6% retracement of the 2008 high to the 2012 low, and at 112.47 we have the 23.6% retracement of the Brexit-move in the pair, and this level saw multiple support inflections in August; and just a few pips above that we have the 112.50 psychological level on the pair.

Of interest on the longer-term setup is whether or not support holds here above the prior swing-low in July at the 110.85 area, which was above the ‘Brexit low’ at 109.54. Should this support hold at 112, top-side plays could be attractive in the effort of trading a longer-term reversal in the pair to look for an eventual break of range resistance. On a near-term basis, traders could investigate bullish positions in the effort of trading the range up to resistance. On the top-side of price action, traders can look for resistance at the 114.30 level which was the swing-high yesterday as well as being the 38.2% retracement of the Brexit move. Just above that we have the 61.8% retracement of the ‘Abe move’ in the pair, taking the 2012 low to the 2015 high.

Welcome to my products:

https://www.mql5.com/en/users/soubra2003/seller