0

133

Welcome to my "Strength and Comparison" article for the coming month, the article "Ranking, Rating and Score" has also been published for this month.

For analyzing the best pairs to trade looking from a longer term perspective the last 12 months currency classification can be used in support.

This was updated on 31 July 2016 and is provided here for reference purposes:

Strong: USD, JPY. The preferred range is from 7 to 8.

Average: CHF, NZD. The preferred range is from 5 to 6.

Weak: EUR, GBP, AUD, CAD. The preferred range is from 1 to 4.

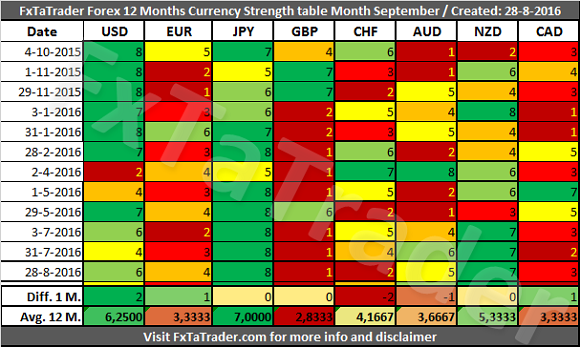

As can be seen in the "Currency Strength Table" here above the NZD has a very strong score of 7 during the last 3 months. Although it is still almost a whole point seperated from the USD, which is the strong currency, the NZD is getting closer to become a strong currency also.

Here below you can see the Monthly Currency Score Chart with 24 months data as a reference showing the the NZD and the USD.

The Forex Currency Comparison Table compares each currency with its counterpart based on the Currency Score. For more information about the currency Score of this month you can read the article "Forex Ranking, Rating and Score" which is published every month together with this article.

By using the comparison table directly below you can get a view without the volatility and statistics as opposed to the "Ranking and Rating list". Only the strength of each currency against the counterparts is analyzed by using the Technical analysis charts of the 3 Time Frames that are also used for the "Ranking and Rating List".

The information from the Comparison Table is the source for calculating the "Ranking and Rating List" where this list uses additionally the volatility and statistics for creating the best and worst performer in the list from number 1 to 28.

The additional analysis of this table compared to the Currency Score table is that the Comparison Table compares the strength between the currencies of each pair. By subtracting the strength of the weaker currency from the stronger currency we have a way to compare each pair combination.

The Comparison Table provides a way to compare currencies from a longer term perspective of 12 months and also simultaneously taking the current trend into account. By coloring the currencies in the X and Y axis according to their Classification we can show what the best combinations are. In doing this we apply 2 rules to make it clearer.

Based on the last "12 months currency classification" and the "Currency Comparison Table" the most interesting currencies for going long seem to be the:

JPY, NZD and the USD.

These are strong or average currencies from a longer term perspective when looking at the last "12 months currency classification".

For going short the same analysis can be done and the following currencies seem to fit best:

GBP, CHF and the CAD.

These are weak or average currencies from a longer term perspective.

Currencies with a high deviation seem less interesting to trade because they are less predictable. These currencies are at the moment e.g. the:

AUD and the CHF.

Unless these currencies offer a clear opportunity based on the longer term they are avoided. However, these currencies may offer opportunities for the short term trader.

Some of these pairs comply for a longer term trade based on the Weekly and Monthly chart. We will look at these ones here in a bit more detail.

The article "Ranking, Rating and Score" published this weekend contains the following interesting pairs:

Besides this article I also use the Forex "Ranking, Rating and Score" which is also available once a week on my blog at FxTaTrader.com. In the article "Ranking, Rating and Score" we look in more detail at the absolute position of the currencies and pairs.

It is recommended to read the page Currency score explained and Models in practice for a better understanding of the article. If you would like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming week.

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours. Thank you.

For analyzing the best pairs to trade looking from a longer term perspective the last 12 months currency classification can be used in support.

This was updated on 31 July 2016 and is provided here for reference purposes:

Strong: USD, JPY. The preferred range is from 7 to 8.

Average: CHF, NZD. The preferred range is from 5 to 6.

Weak: EUR, GBP, AUD, CAD. The preferred range is from 1 to 4.

______________________________________

12 Months Currency Score Strength

The 12 Months Currency Strength and the 12 Months Average are provided here below. This data and the "12 months currency classification" are considered for deciding on the preferred range. Because it is not ideal nor desired to change the range for a currency every single month, we perform several checks to avoid this.- First of all the strength over a period of 12 months. See each row for more information.

- Then the 12 months average, see the last row called "Avg. 12 M."

- The number of months that a currency is stronger than another currency can also be evaluated.

- The TA Charts for each Time Frame can also be consulted.

- Besides these the "12 monhts Currency Classification" chart of each currency is also consulted and compared.

Here below you can see the Monthly Currency Score Chart with 24 months data as a reference showing the the NZD and the USD.

______________________________________

Currency Score Comparison

"Comparison Table" and the "Ranking and Rating list"

By using the comparison table directly below you can get a view without the volatility and statistics as opposed to the "Ranking and Rating list". Only the strength of each currency against the counterparts is analyzed by using the Technical analysis charts of the 3 Time Frames that are also used for the "Ranking and Rating List".

The information from the Comparison Table is the source for calculating the "Ranking and Rating List" where this list uses additionally the volatility and statistics for creating the best and worst performer in the list from number 1 to 28.

"Comparison Table" and the "Currency Score Chart"

The Comparison Table provides a way to compare currencies from a longer term perspective of 12 months and also simultaneously taking the current trend into account. By coloring the currencies in the X and Y axis according to their Classification we can show what the best combinations are. In doing this we apply 2 rules to make it clearer.

- First of all only better classified currencies in combination with weaker classified currencies are "Approved".

- The only exception is when 2 currencies are similarly classified but the Currency Score difference is equal to or more than 4.

- It means that each currency should be as far apart from each other as possible in the range from 1 to 8. This means that the classification of the currencies in question may change in the longer term. By using the difference of 4 which is exact the half of the range it seems a safe approach for trading 2 currencies which are similarly classified.

- Since each classification covers only 2 or 3 scores at the most it means that the currencies should be at least one classification apart from each other in the current month.

- Even though they are in the same classification when looking at the 12 months average a currency may be in a weaker/stronger period and may even change its classification in the future. See the current classification for the coming period at the top of this article.

______________________________________

Putting the pieces together

Based on the last "12 months currency classification" and the "Currency Comparison Table" the most interesting currencies for going long seem to be the:

JPY, NZD and the USD.

These are strong or average currencies from a longer term perspective when looking at the last "12 months currency classification".

For going short the same analysis can be done and the following currencies seem to fit best:

GBP, CHF and the CAD.

These are weak or average currencies from a longer term perspective.

Currencies with a high deviation seem less interesting to trade because they are less predictable. These currencies are at the moment e.g. the:

AUD and the CHF.

Unless these currencies offer a clear opportunity based on the longer term they are avoided. However, these currencies may offer opportunities for the short term trader.

Some of these pairs comply for a longer term trade based on the Weekly and Monthly chart. We will look at these ones here in a bit more detail.

- When analyzing the Monthly and Weekly charts the best pairs for the coming week seem to be the:

GBP/JPY, GBP/NZD, GBP/USD, CHF/JPY, CAD/JPY, GBP/AUD, EUR/JPY, AUD/JPY, GBP/CHF, NZD/CAD and the EUR/NZD - A crossed join between the Top 10 pairs in the "Ranking and Rating List", the "Currency Comparison Table" and the pairs with the best charts mentioned here above shows the following interesting pairs:

GBP/JPY, GBP/NZD, GBP/USD, CHF/JPY, CAD/JPY, GBP/AUD, EUR/JPY and the AUD/JPY. - All the pairs are mentioned as "Approved" pairs in the "Currency Comparison Table".

- The GBP/CHF, NZD/CAD and the EUR/NZD are not mentioned in the Top 10 of the Ranking and Rating list.

______________________________________

- GBP/JPY with the NZD/CHF

- GBP/NZD with the CHF/JPY

- the order in that list,

- the Currency score difference in the "Currency Comparison Table"

- and how the charts in the different Time frames are looking.

______________________________________

It is recommended to read the page Currency score explained and Models in practice for a better understanding of the article. If you would like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming week.

______________________________________