RBA’s Lack of Dovish Forward Guidance Provides Support For AUD

RBA’s Lack of Dovish Forward Guidance Provides Support For AUD

Fundamental Forecast for the Australian Dollar: Neutral

• Dovish Components RBA’s SMP Mainly Result of External Factors, Favoring AUD Resilience

• Australian Dollar Sentiment Points to Gains

• For up-to-date and real-time analysis on the AUD and market reactions to economic factors currently ‘in the air,’ DailyFX on Demand can help.

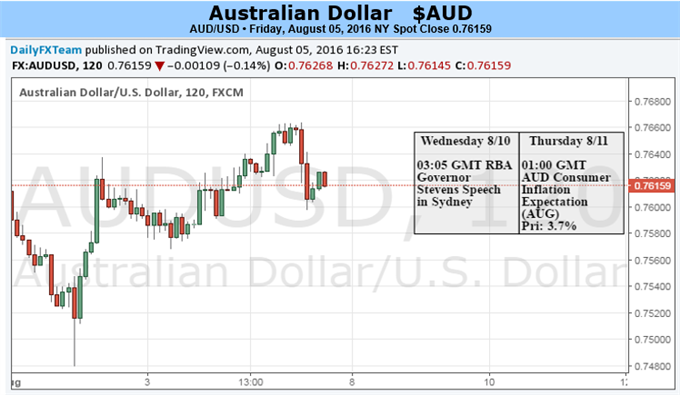

The Australian Dollar touched its highest level against the U.S. Dollar on Thursday at 0.76632 since July 15 before the Statement of Monetary Policy provided little forward guidance that caused traders to take their profits. On Friday morning, the Australian Dollar joined the rest of G10 FX by taking a back-seat to the US Dollar after the Non-Farm Payroll Numbers shattered expectations by coming in at 255k vs. expectations of 180k. Such a beat comes after June’s report of 292,000. Therefore, it would be short-sighted to think the $A is weak by looking at AUDUSD because USD is strong across the board.

This week was full of key economic data for Australia including the Trade Balance, Building Approvals, the RBA Cash Target Rate, and Retail Sales. As you can imagine, the headliner was the RBA cash rate cut of 25bps from 1.75% to 1.50%. Despite the cut, the lack of guidance showing a preference for another cut in light of a rather robust local economy has supported the Australian Dollar across the board. Additionally, the RBA failed (likely on purpose) to downgrade the inflation forecast any further, and didn’t seem bothered by the appreciating AUD as they had in the past.

Other key points this week that caught trader’s attention was the Trade Balance that showed more exports than expected via the Trade Balance that came in at $A -2B. Also, the round out the week full of economic data was the Retail Sales MoM that beat expectations at 0.3% vs. 0.1% expectations.

Towards the week’s close, the Australian Dollar was performing best against commodity counterparts and the JPY.

Three key data points will be in store for AUD traders next week with ANZ Job Advertisements, NAB Business Conditions/Confidence, Home Loads, and most importantly the Westpac Consumer Confidence MoM

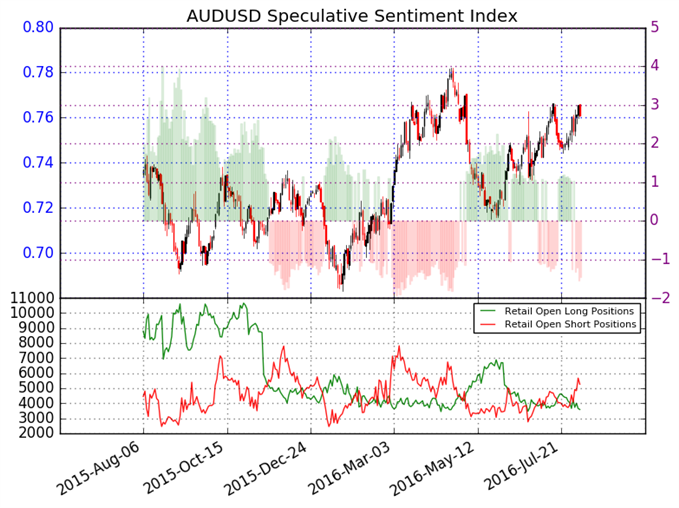

Australian Dollar Sentiment Points to Gains

The ratio of long to short positions in the AUDUSD stands at -1.63 as 38% of traders are long. Long positions are 8.4% lower than yesterday and 10.6% below levels seen last week. Short positions are 11.8% higher than yesterday and 43.6% above levels seen last week.

We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives a signal that the AUDUSD may continue higher. The trading crowd has grown further net-short from yesterday and last week. The combination of current sentiment and recent changes gives a further bullish trading bias.

https://www.mql5.com/en/market/product/16143