- Gold and silver positioning in unchartered waters

- Specs buy Mexican pesos

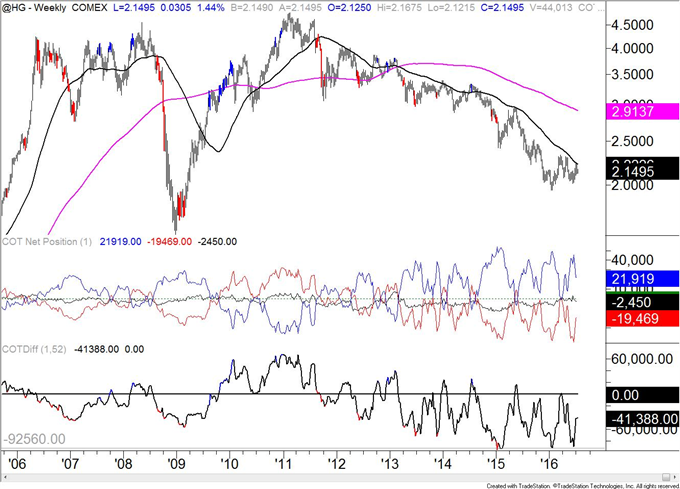

- Copper specs still getting squeezed

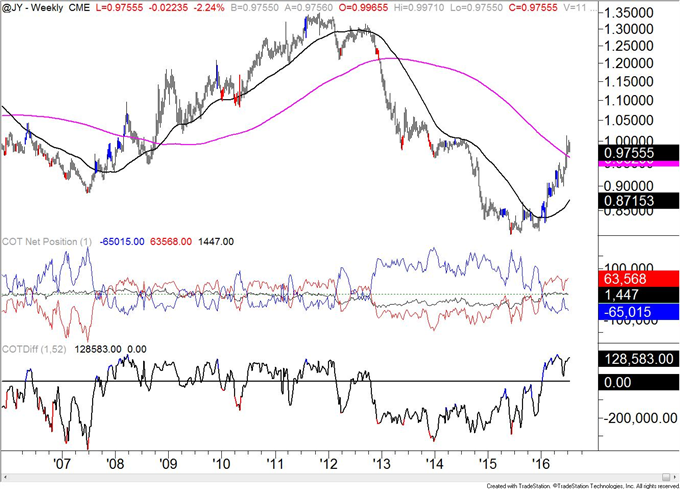

The COT Index is the difference between net speculative positioning and net commercial positioning measured. A blue colored bar indicates that the difference in positioning is the greatest it has been in 52 weeks (bullish) with speculators selling and commercials buying. A red colored bar indicates that the difference in positioning is the greatest it has been in 52 weeks (bearish) with speculators buying and commercials selling. Non-commercials tend to be on the wrong side at the turn and commercials the correct side.

Latest CFTC Release dated July 5th, 2016

Week (Data for Tuesdays) | 52 week Percentile |

20 | |

53 | |

18 | |

75 | |

90 | |

84 | |

90 | |

Mexican Peso | 67 |

Gold | 100 |

Silver | 100 |

Copper | 69 |

Crude | 77 |

Charts (all charts are continuous contract)

Non Commercials (speculators) – Red

Commercials – Blue

Small Speculators – Black

COTDiff (COT Index) – Black

US Dollar ICEUS Continuous Contract

Euro CME Continuous Contract

Australian DollarCME Continuous Contract

Japanese YenCME Continuous Contract

Canadian DollarCME Continuous Contract

Swiss Franc CME Continuous Contract

Mexican Peso CME Continuous Contract

Gold COMEX Continuous Contract

Silver COMEX Continuous Contract

Copper COMEX Continuous Contract

Crude Oil NYMEX Continuous Contract