USD/CAD Constructive Above Weekly Open- Key Resistance 1.3020

- USD/CAD eyes range highs into the July open

- Updated targets & invalidation levels

Broader Technical Outlook: Loonie remained range-bound for the better part of June trade with the pair continuing to hold within the confines of an ascending channel formation off the 2016 low. Dollar seasonalities turn p[retty heavy in early July trade but we’re likely to see a bit more back-and-forth here before the next leg lower. Daily resistance is eyed with the 100-day moving average at ~1.3027 backed bybearish invalidation at the May high-day close at 1.3121 (note that USDCAD topped precisely at that level last week). A break below basic trendline support targets the 2016 & June low-day closes at 1.2723 &1.2692 respectively (bullish invalidation).

Notes: We covered this setup at length in today’s strategy webinar on SB Trade Desk with the pair turning just ahead of confluence resistance at 1.2976 where the upper median-line parallel converges on the 50% retracement of the post-Brexit pullback. Note that the pair has cleared its initial weekly opening range & keeps the focus weighted to the topside while above the median-line with interim support seen at 1.2945backed by the monthly open / weekly open at 1.2913/24- bullish invalidation.

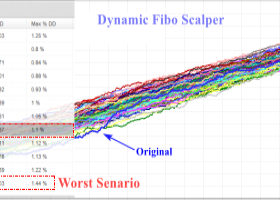

A breach above near-term resistance targets key topside resistance at 1.3010/15 where the 1.618% sliding parallel converges on the 61.8% retracement and the 5/9 & 6/30 swing highs- an area of interest for possible exhaustion / short-entries. A quarter of the daily average true range (ATR) yields profit targets of 28-30 pips per scalp. Added caution is warranted heading into the close of the week with the U.S. & Canadian employment reports on tap for this Friday- expected increased volatility. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount.

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

Relevant Data Releases

Other Setups in Play: