GBP/USD already 200 pips off the lows – sell opportunity or Bregret hopes?

Forex trading is never a one way street. What comes down must come up, at least temporarily. And that is the big question for the pound.

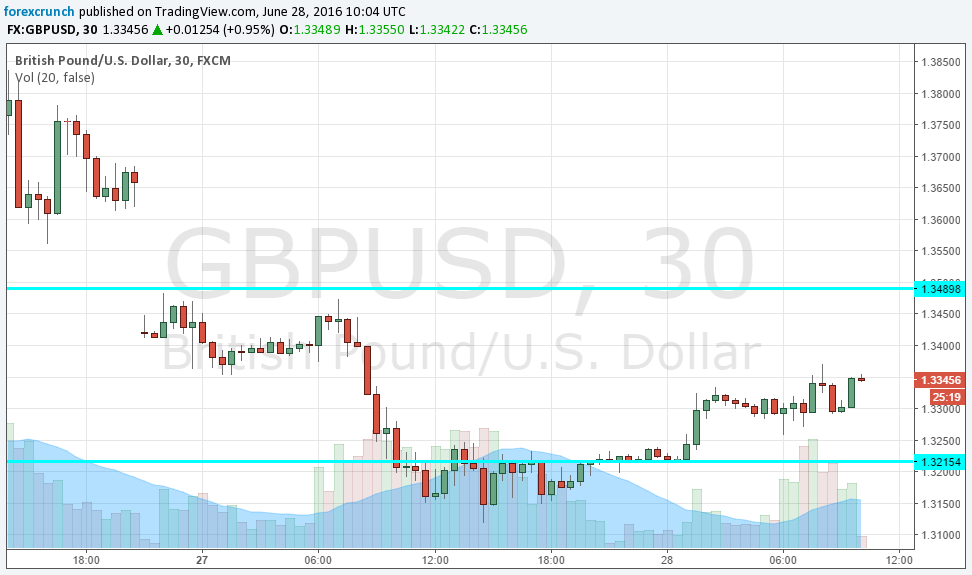

The third trading day following the Brexit night sees a positive trend for the pound after huge falls beforehand. GBP/USD is 200 pips off the low of 1.3124 but is still in levels last seen in 1985 and over 1600 off the pre-Brexit peak. On the charts, this looks like “dead cat bounce” – a relatively small correction in the bigger scheme of things even if the move is significant in absolute terms.

If this is indeed the case, we have a sell opportunity. The bounce on Friday helped the pair settle 400 pips off the highs. This was followed by a weekend gap and a crash on Monday. Many analysts see 1.30 or even lower as near term targets. The rise is accompanied by a stock market bounce and the mood could soon deteriorate.

But perhaps there is a real chance for change here: the reluctance of the UK government to invoke Article 50 immediately is explained by the wait for a new leadership. In addition, Brexit seems like something nobody wants to touch with a barge pole: also the lead candidate to replace Cameron at No. 10, Boris Johnson is not too keen on hurrying out.

Will we have a Bregret: a regret of the vote to exit? This may be overturned easily by having Scotland rule that out. According to some legal experts, all devolved powers need to approve the exit, but there is no consensus. Another path out would be via a vote in parliament: most MPs oppose the move. Another route would be choosing a pro-Remain PM such as Theresa May, Cameron’s minister of interior.

GBP/USD could find resistance at 1.35, which is a round number and this week’s high. Support is at 1.3250, which separates ranges.

Here is how it looks on the chart: