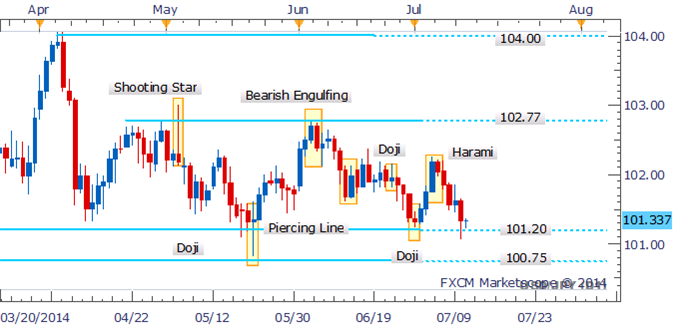

USD/JPY Technical Strategy: Pending Long

Harami delivers declines to range-bottom at 101.20

Awaiting key reversal pattern to signal a recovery

USD/JPY has extended recent declines on the on the back of a Harami pattern on the daily which suggested the bears were looking to take control of prices. However, the candlestick formation may fail to find further follow-through given the long-held range-bottom rests nearby at 101.20. A Doji appears to be forming on the daily in intraday trade, however the candlestick is insufficient to suggest a bullish reversal at this point.

USD/JPY: Awaiting Reversal Signals Near Range-Bottom

Scrutinizing the four hour chart; a Piercing Line formation suggests the

bulls are not yet prepared to relinquish their grip on prices. However,

the extent of a recovery may be limited by overhanging resistance at

the 101.45 mark.

USD/JPY: Piercing Line Pattern Demonstrates Resilience By The Bulls