USD/JPY Recovers from Session Low, Still in Red at 107.00

The USD/JPY pair attracted some buying interest near session low levels on slight improvement in the risk appetite, lifting the pair back above 107.00 handle.

Recovery witnessed in the Japanese equity markets supported a minor risk-on bounce for the pair. Adding to it, Chinese imports data indicated that the domestic demand in the world's second-largest economy might be recovering, took Yen bulls on the back-foot.

Meanwhile economic data from Japan showed economy grew by 0.5% on a q-o-q basis during the first-quarter of 2016 while on a yearly basis; the economy recorded a growth of 1.9%. The reading was in-line with market expectations and thus, restricted further recovery for the USD/JPY pair.

Ahead of next week's widely watched FOMC meeting, the pair is likely to cues from the risk-on/off sentiment across global equity markets.

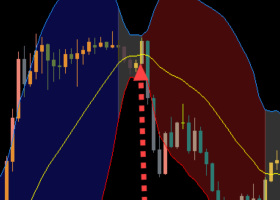

Technical outlook

Valeria Bednarik, Chief Analyst at FXStreet notes, "the 4 hours chart shows that the price remains far below its moving averages, having met selling interest around the 61.8% retracement of the latest daily bullish run, while the Momentum indicator aims higher above its 100 level, and the RSI hovers near oversold territory, leaving limited room for further advances. Should the price extend below 107.00, the bearish continuation will get confirmed, with scope then to extend to fresh weekly lows in the 106.00/20 region."

"Support levels: 106.95 106.60 106.20

Resistance levels: 107.85 108.40 108.00"

![]()