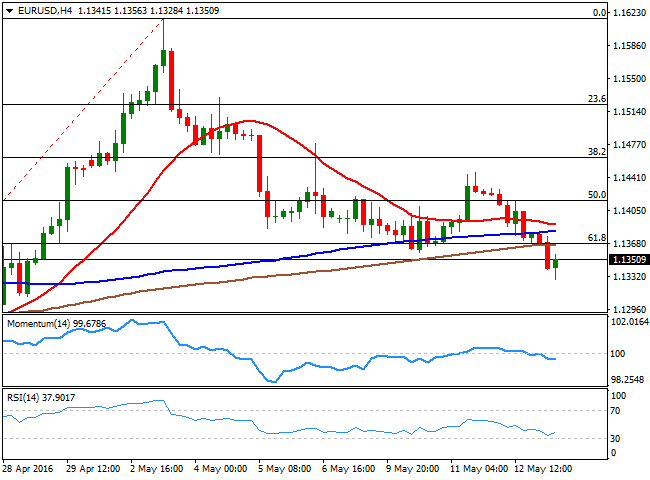

EUR/USD Forecast: Fresh Lows, Looking for 1.1250

The EUR/USD pair fell to 1.1328, a fresh weekly low, following the

release of German data, showing that inflation remains within

deflationary territory, down by 0.4% monthly basis, and -0.1% compared

to a year before. The readings were in line with market's expectations,

but still a bad sign. Preliminary GDP for the first quarter in the

country, grew more than expected, up 0.7%, but year on year basis it

resulted at 1.3%, against 2.1% previous.

The EU Q1 GDP was not that encouraging. The region grew 0.5% during the

first three months of the year, while the yearly reading came in at

1.5%, both missing expectations and below previous. Asian shares are

sharply lower, while European ones opened in the red amid poor data.

The pair managed to bounce some from the mentioned low, but holds near

its and the 4 hour chart shows that the recovery stalled well below the

61.8% retracement of the latest bullish run at 1.1370, whilst the

technical indicators head lower within bearish territory and that the

price is well below its moving averages, all of which maintains the risk

towards the downside.

Renewed selling pressure driving the pair below 1.1310,

moreover on positive data coming from the US later on the day, should

see the pair extending its decline down to 1.1240/60, while below this

last, a test of 1.1200 seems possible.

Above 1.1370, the pair can recover up to 1.1420, although further advances seem unlikely for today.

![]()