Banxico Preview: No Reason Now – Rabobank

Christian Lawrence, Senior Market Strategist at Rabobank, suggests that

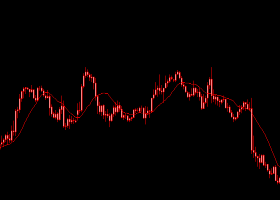

when Banxico moved between meetings, price action was in a very

different place to where it is now.

Key Quotes

“That

was just after the trough of the Jan-Feb sell-off and USD/MXN was at

18.94 having rallied nearly 12% since the start of the year alone. We

had clear signs that inflation had already bottomed out and was heading

higher. Fast forward to the present day and USD/MXN is 10% off the

February 11th peak, while inflation has come off the February highs and

price pressures are already showing some signs of easing. In short,

there is no immediate need for a rate hike.

Looking north of the

border, the Fed still matters for Banxico policy. We fully expect

Banxico to follow the US if the Fed raises rates and so our base case is

for two 25bp rate hikes in Mexico this year. That said, we are also

aware that Banxico has a somewhat pre-emptive reaction function that

will see them err on the side of caution when it comes to potential

shocks.

Furthermore, the Bank has been clear in its view that

interest rate hikes are a preferred tool over FX intervention and should

we see a sell-off like in January then there would be significant risk

of another Banxico rate hike. Given that, we see the risk as firmly

skewed to the upside when it comes to our base case of two 25bp hikes

and potentially 100bp could easily be plausible, particularly given that

we are expecting MXN weakness (driven by global sentiment souring and

MXN’s high beta profile) going forward.

Returning to the

domestic picture, the room to hike is obviously dependent on inflation.

This has clearly bottomed out having previously been suppressed by

limited pass-through from non-tradeable goods and the one off impact of

some structural reforms at the back end of last year but we do not see

excessive upward price pressures likely to force the Bank’s hand anytime

soon.

March’s CPI inflation data saw a contraction in furniture

and food, beverages and tobacco categories which is interesting given

we haven’t seen a negative print in these two components since May 2015

and we expect this to be unwound in April but our expectation is for a

steady print of 2.6% y/y in April.”

![]()