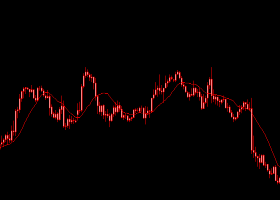

EUR Fundamentals Remain a Mixed Bag - TDS

Research Team at TDS, suggests that the ECB hopes it delivered its last

bout of easing in March, and will be content to sit on the sidelines for

an extended period of time (rising oil prices will help).

Key Quotes

“€80b/m

QE kicked off this month and corporate debt buying starts in June. Bank

lending is picking up in response to easy policy, and consumers are

spending. Event risk remains the key downside risks to the euro area –

in particular in Italy (banks) and Greece (debt).

2-way risks

should predominate as EUR fundamentals remain a mixed bag. Continued ECB

dovishness and spillover risks from the UK referendum are likley to

keep a lid on gains. We see scope for better performance ahead, however,

on certain crosses (especially vs GBP, AUD, CAD), as relative value

strategies may present the best risk/reward opportunities.”

![]()