Daily Analysis of Major Pairs for April 29, 2016

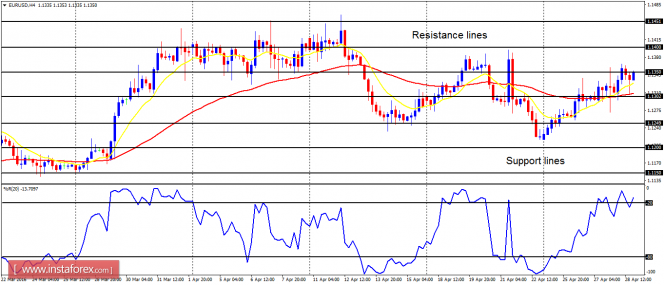

EUR/USD: The perpetual rally on the EUR/USD has resulted in a more vivid threat to the present bearish bias in the market. From the beginning of this week till now, the bulls have pushed the price upwards gradually – and this is something that has generated a "buy" signal. The EMA 11 has almost crossed the EMA 56 to the upside as the Williams' % Range period 20 has gone into the overbought region. Long trades would make sense here.

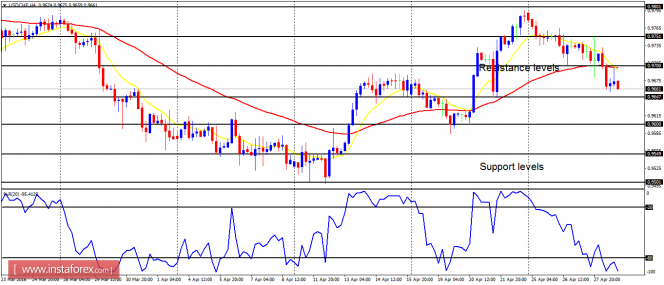

USD/CHF: The perpetual correction on the USD/CHF has resulted in a more vivid threat to the present bullish bias in the market. From the beginning of this week till now, the bears have dragged the price downwards gradually – and this is something that has generated a "sell" signal. The EMA 11 has almost crossed the EMA 56 to the downside as the Williams' % Range period 20 has gone into the oversold region. Please sell short.

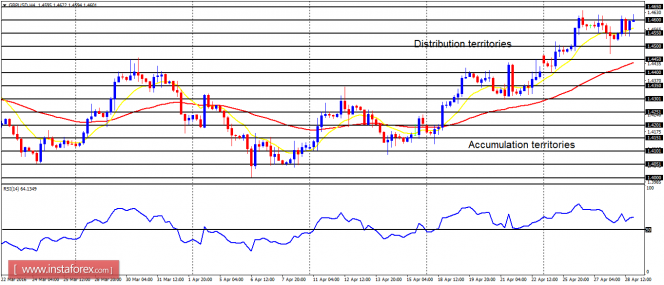

GBP/USD: This is a bull market. The Cable has gone upwards this week, but it has met a strong opposition at the distribution territory of 1.4600. The distribution territory has been tested many times without being breached to the upside. With further buying pressure in the market, the distribution territory would be broken to the upside as the bulls push the price further north.

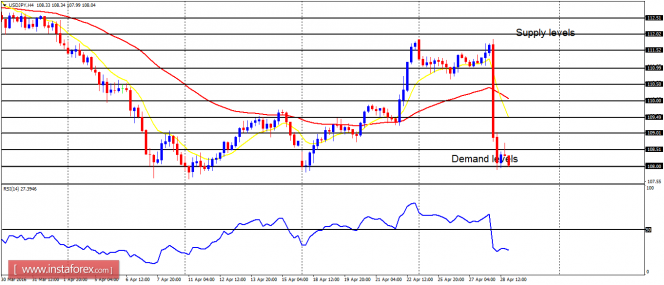

USD/JPY: This pair moved sideways between Monday and Wednesday and dropped like a stone on Thursday. That drop was strong enough to bring about a new Bearish Confirmation Pattern on the 4-hour chart. The EMA 11 has gone below the EMA 56, while the RSI period 14 is below the level 50. The price is expected to go further south, reaching the demand levels at 107.50 and 107.00.

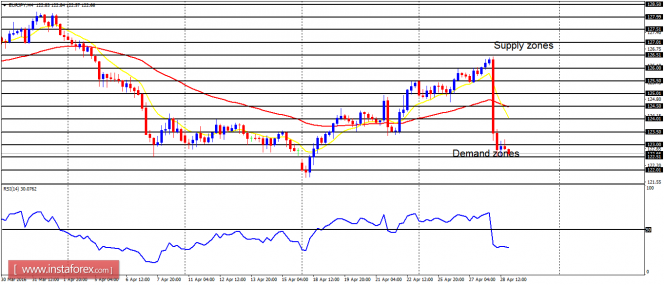

EUR/JPY: The EUR/JPY went upwards from Monday to Wednesday this week, but broke down as a result of the fundamental figures released on Thursday. The price skydived by 370 pips, almost testing the demand zone at 122.50. This large pullback has resulted in a bearish signal in the market, for the price is supposed to go further south today and next week.