The question that arises is:

why this happens?

trading is so difficult that only a select few can be successful?

The answer is NO;

Anyone can potentially be a good trader but the precise conditions.

The forex trading is a very lucrative.

For this attracts many beginners, enticed by easy money.

More or less, after an hour of study on how a trading platform, everyone is capable of placing an order and probably why you have the illusion that being a trader is not that complicated, and that the millions are behind 'angle!

Maybe it can happen that the first trade are lucky and you think so that you understand everything already beginning to increase the size of the positions.

Then at some point, there comes a big unexpected loss that halves its capital.

The trader then improvised seeks to recover everything at once. But things do not work like the beginning and the capital continues to decline inexorably toward zero.

This is a stereotypical scenario, but not very far from reality. The problem is that very often beginners are thrown into the market with large sums of money or the opposite with too little money (you can not trade with 100 euro !!!), hurried to realize substantial gains without really knowing what they do.

There are many other lucrative professions in the world:

the lawyer, the bank, the doctor, etc.

These professions, however, require several years of study and apprenticeship before getting a significant economic return.

So why the trading be any different?

Trading is a profession like any other.

It can be carried out not only as a part-time employment (for an extra gain with respect to a "classical work"); but also as a real profession in any case, however, it serves to study and acquire specific knowledge.

When you start with real money it is important to start with caution opening small positions. The key point is not to win a lot at once, but you stay in the game long enough to really know how to move and start making money really.

There are 3 KEY CONCEPTS that an aspiring trader absolutely must know before you start.

1. Rigorous method:

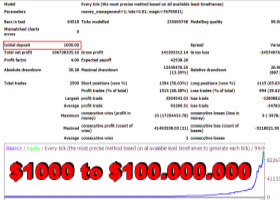

It 'important to choose a strategy that suits your trading style and stick to the strategy without inventing. Trading is a systematic business; trusting intuition can lead to some lucky winning but eventually not work.

2. Money management:

Manage capital is critical. The secret to success in trading is to preserve its capital no matter what. And 'basic figure out the right balance between maximizing profit and keep the risk under control.

Only good money management will allow you to make money from the success of your trading strategy.

3. Cold Mind:

Psychology in trading is an aspect overlooked but is very important. When there is money at stake stress increases compromising our lucidity in making decisions. It tends to close in profit positions prematurely to cash a quick profit. On the contrary it tends to leave open too long losing positions hoping they can recover. This means that the winnings are smaller than the losses and the long run this destroys the trader's capital. Psychology in trading is important to be able to implement its strategy without greed or fear. The good trader learns to have confidence in their system after the "defeat"; likewise he knows how not to get carried away too much even after many "victories."