EUR/USD Rejected at Stiff Resistance Zone After ECB

ECB rate decision and Draghi’s press

conference was a dud as expected. EUR/USD was on the rise ahead of the

rate decision and extended gains to near 1.14 levels during Draghi’s

presser.

Decoding Draghi is very simple since there is nothing to

decode as Mr. President was on a self congratulatory mode, stating that

theirs is the only monetary policy in last four years that has

supported growth. Draghi reiterated the same old message again –

Nothing

new or groundbreaking came through as all of the above points are well

known to the markets. The last comments is somewhat encouraging for the

EUR bulls as it would mean sell-off in oil would have less impact on

inflation expectation.

Market reaction

German yield

curve steepens – Long duration bund yields are up anywhere between 6 to 8

basis points. Yields were on the rise heading into the ECB as the

central bank was not expected to announce fresh stimulus measures. Short

duration yields are lagging far behind long duration yields.

EUR

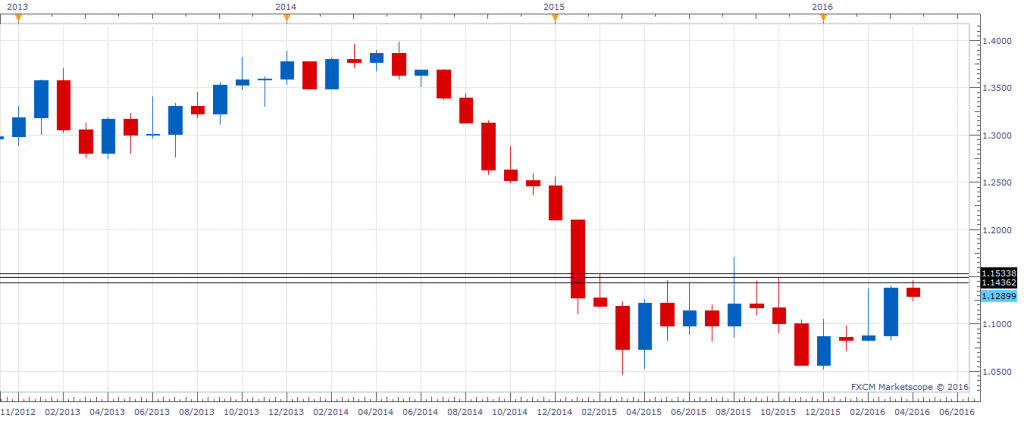

rejected at 1.14 – EUR/USD clocked a high of 1.1398 as anticipated by

us before falling back to 1.13 levels. EUR/GBP had found support at

50-DMA ahead of the ECB release and jumped to 0.7898 before trimming

gains slightly to 0.7885 levels.

What’s next for EUR/USD?

The

focus now shifts to next week’s Fed. Markets are not even considering a

slight possibility of a rate hike next week. Probability of a June rate

hike is thin as well. Post June, US election would take center stage,

hence markets believe Fed is unlikely to move between June and Nov. So

markets are betting on a rate rise in December.

However, there is

always some amount of caution ahead of the FOMC rate decision and that

could see a rise in demand for the USD. Plus, correction in Oil and

renewed Yen buying could also pull EUR/USD lower (via fall in EUR/JPY).

Moreover, the pair faces a stiff resistance in the zone of 1.1436-1.1534 as can be seen on the monthly chart below.

EUR/USD monthly Chart

![]()