Dear Traders,

The euro began to drift lower ahead of the European Central Bank meeting today. Market participants now wonder whether this could be the beginning of a renewed downtrend in the EUR/USD. This could indeed be the case, as we currently see a higher likelihood of upcoming bearish momentum (see technical analysis below).

However, the euro might be vulnerable to volatile swings ahead of the ECB press conference, where Mario Draghi will have the opportunity to provide investors with clues about the path of monetary policy. While the ECB is not expected to change monetary policy in April, Draghi could signal the potential for easing. But everything is relative and when it comes to speculation about the central bank’s path, the market’s reaction does not necessarily always go hand in hand with the central bank’s forecasts. The market is rather skeptical about any future projections and therefore we only believe in what we see. And that is the technical picture.

The ECB will announce its rate decision at 11:45 UTC, while Draghi will hold a press conference 45 minutes later.

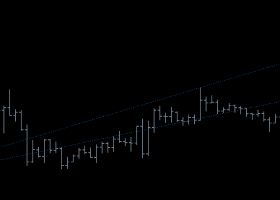

EUR/USD

The daily chart shows a possible head-shoulders formation (SHS), which may predict upcoming bearish momentum. After a break below 1.1230/20, we will focus on the lower support zone around the 1.1150-level. Depending on the degree of investors’ risk appetite, market participants may push down the pair towards 1.1070 but this may not happen today as pullbacks are becoming increasingly likely around these support levels. The SHS-pattern is void as soon as the euro marks prices above 1.1390. In case of a renewed rise above 1.14, we could see an appreciation towards 1.1450 and 1.1520.

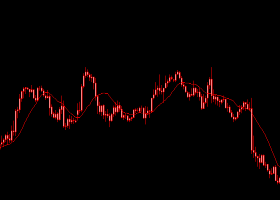

The British pound traded sideways between 1.4410 and 1.4345. As long as the resistance at 1.44 remains unbroken, we favor the downtrend but the cable must break significantly below 1.43 in order to revive fresh bearish momentum. Next lower targets could then be at 1.4270 and 1.4230. U.K. Retail Sales are scheduled for release at 8:30 UTC, a report which could affect the price action in the GBP/USD. Furthermore, BoE Governor Mark Carney is due to speak at 14:00 UTC.

From the U.S. we have the Philly Fed Index scheduled for release at 12:30 UTC.

Daily Forex signals:

View our daily signal alerts http://www.maimar.co/category/daily-signals/

Subscribe to our daily signal service http://www.maimar.co/signals/

We wish you good trades and many pips!

Any and all liability of the author is excluded.

Copyright © All Rights Reserved 2016 Maimar-FX.