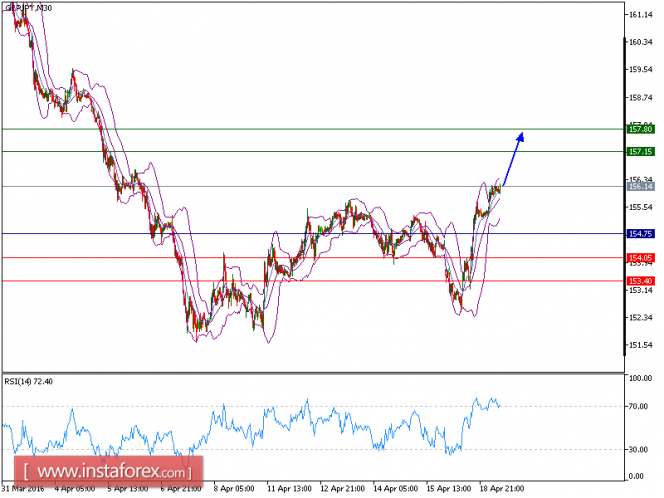

Technical Analysis of GBP/JPY for April 19, 2016

GBPY/JPY is expected to trade in a higher range and the pair is expected to continue its upside movement. The pair is turning up and is supported by its rising 20-period moving average. Meanwhile, the relative strength index stays above 50. Further upside is therefore expected with the next horizontal resistance and overlap set at 157.15 at first. A break above this level would call for further advance toward 157.80 in extension.

Trading Recommendations:

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 157.15 and the second one, at 157.80. In the alternative scenario, short positions are recommended with the first target at 154.05 if the price moves below its pivot points. A break of this target is likely to push the pair further downwards, and one may expect the second target at 157.80. The pivot point is at 154.75.

Resistance levels: 157.15, 157.80, 158.60

Support levels: 154.05, 153.40, 152

The material has been provided by